Recap: In my fourth month (January) I had a record-high option trading profits of $188 in my mortgage pay off strategy, however my principal in the trading account barely grew and sat at $3,515.08. In total, I had paid a total of $256 extra principal towards the mortgage, which will equal a total savings of $393 over the life of the loan. In total across my four diversified strategies, I had earned a return of $513.33 on my $3,492.63 total investment, which is 14.7% or a CAGR of 50.9%. Impressive numbers, and way beyond my initial goals. And most certainly not sustainable! (If it were sustainable, I will be opening my own hedge fund by the end of this.)

Thanks in large part to beginning to implement some synthetic covered calls (aka “poor man’s covered call” or “PMCC”) and some luck in timing the market, February was another record-setting month. I earned $199 in options trading profits, a 5.5% return on capital and another record! I was able to grow my principal up to $3,964.77 which is 13.3% more than the previous month. More details on the breakdown of profits across the four strategies below, but first my positions and trades…

My positions & trades

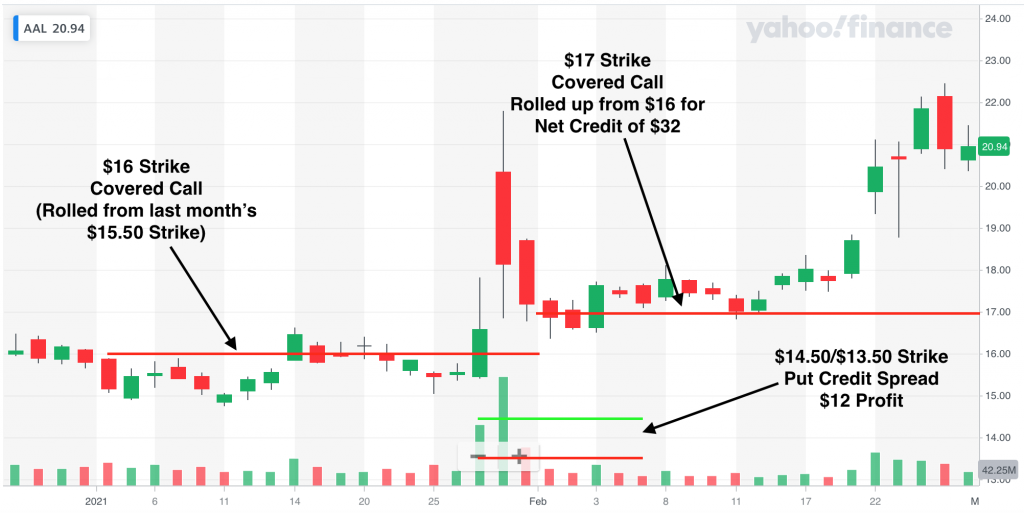

$AAL, 100 shares at $13.98 average ($1,398 total principal). Principal is now currently up an astounding 51% ($713.08), however I am capped at $17 due to a $17 strike covered call position expiring March 19. Therefore, my capital gains are limited to just $302 total. I closed two positions for the month and for a profit of $39 (one put credit spread and one covered call). Similar to last month, I collected a net credit of $16 after rolling up from a $16 strike position to the current $17 position.

I have yet to decide whether I will try to roll up again or just out to April, assuming I can get an acceptable return. American Airlines is now getting to a point where I think it doesn’t have that much more upside from the county reopening. Basically, I think all of that is already priced in. For that reason, I am leaning toward rolling to another $17 strike. Implied Volatility remains high, so I should be able to get a decent return for that.

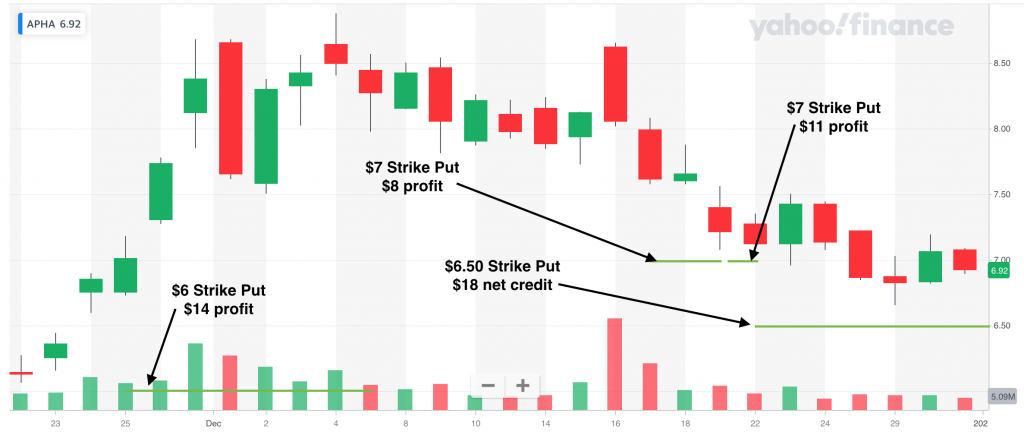

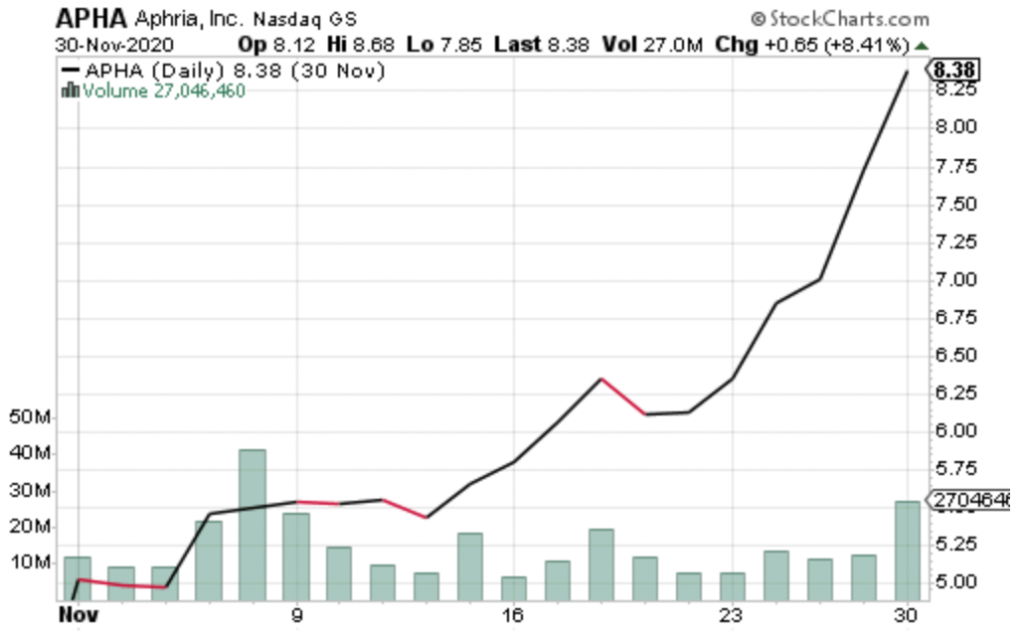

$APHA, no open positions. This month I traded two put credit spreads on Aphria. It’s had quite a run up, so was able to close both out for profit. Downside of selling puts is that the maximum profit is capped. When you have incredible run-ups like $APHA did it’s hard not to have FOMO. Still, ROI on these was nothing to complain about. The two trades totaled $43 in profits. With $100 at risk over the course of 14 days is an annualized ROI of 112%!

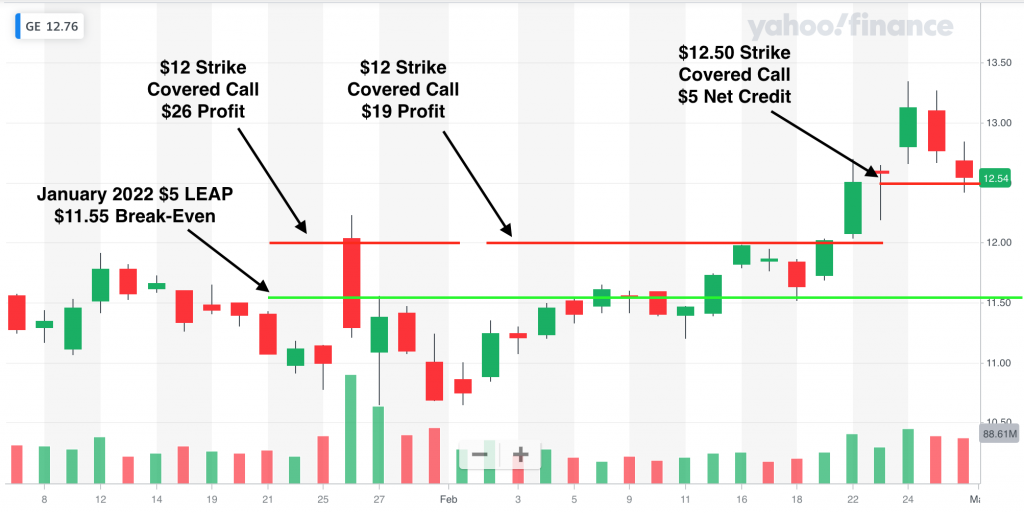

$GE, 1 LEAP January 21, 2022 $5 Strike Call at a cost of $6.55; 1 March 26 $12.50 Covered Call. As I wrote last month, I am trying synthetic covered calls (aka “poor man’s covered call” or PMCC) for the first time. Both of my trades are going really well. With $GE trading at $12.54 now, that $5 strike LEAP is now worth $7.55, which is a $100 profit right now. In addition, I closed two covered call positions during February for $45 total profit. Those covered call positions were at the $12 strike. I rolled the second one up to the current March 26 $12.50 strike covered call for a net credit of $5.

If my covered call gets assigned at $12.50, my $5 LEAP will be forced to be exercised and the spread will be what I take home. So $750 here. For that reason, when calculating my total principal, I cap this position at $750 (unless I roll it up to a higher strike).

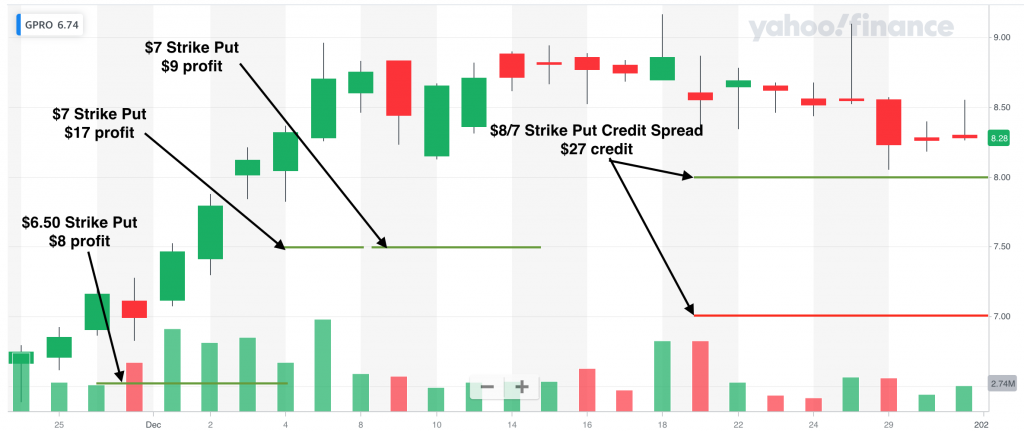

$GPRO, no open stock positions. I only had one trade on Go Pro in February, a $1 wide put credit spread. I opened the $8/$7 strike position after the stock had dropped considerably. I actually was wrong on the direction of this trade, as the stock continued to go below my short strike, as shown in the chart below. Thanks to theta (time decay) and vega (reduction in volatility), this one was on the side of the option seller. I closed the position for a small, $6 profit. This month I have sold some cash-secured puts at $7.50 strike.

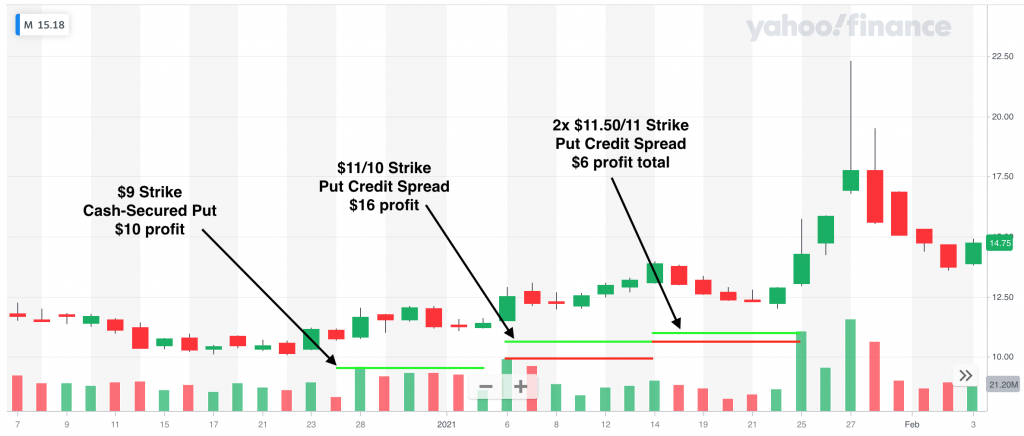

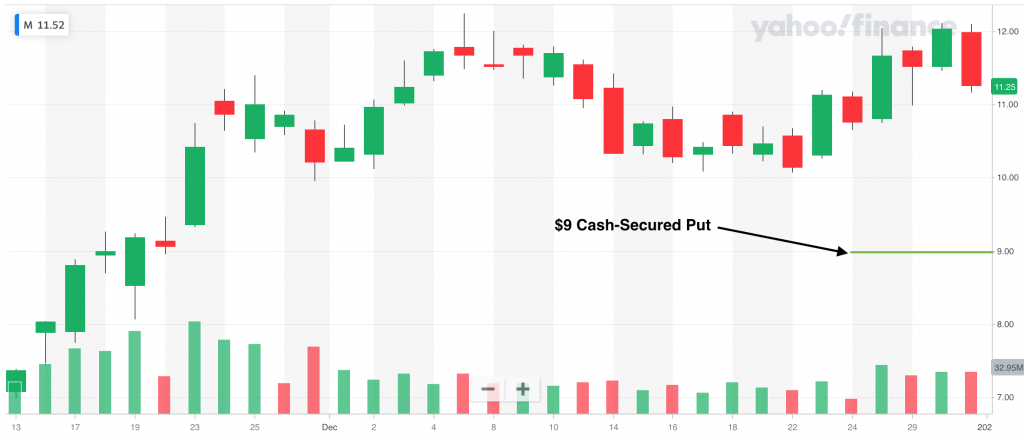

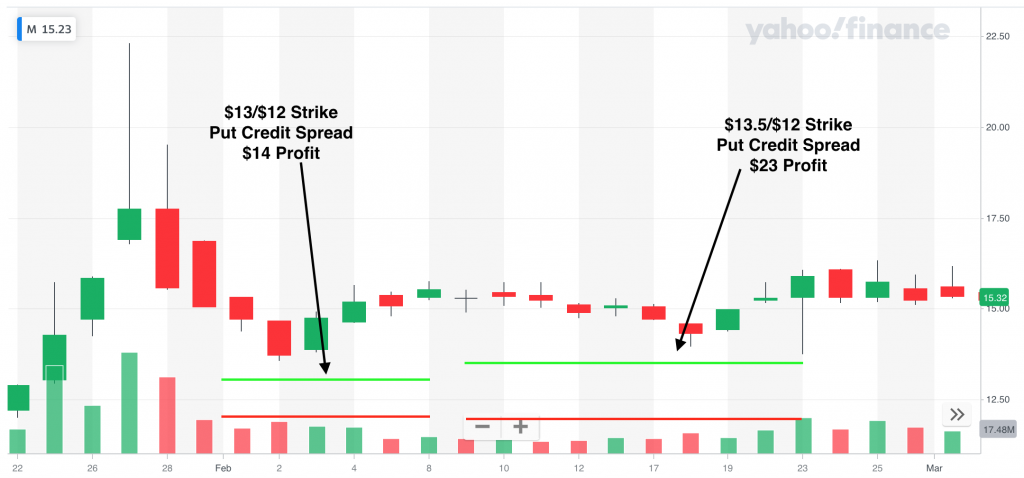

$M, no open positions. I continued from last month selling put credit spreads on Macy’s. The premiums were good and the volume was also good making spreads more attractive. I find it hard to get orders filled for spreads on the less liquid stocks sometimes. I closed two trades for a total profit of $37.

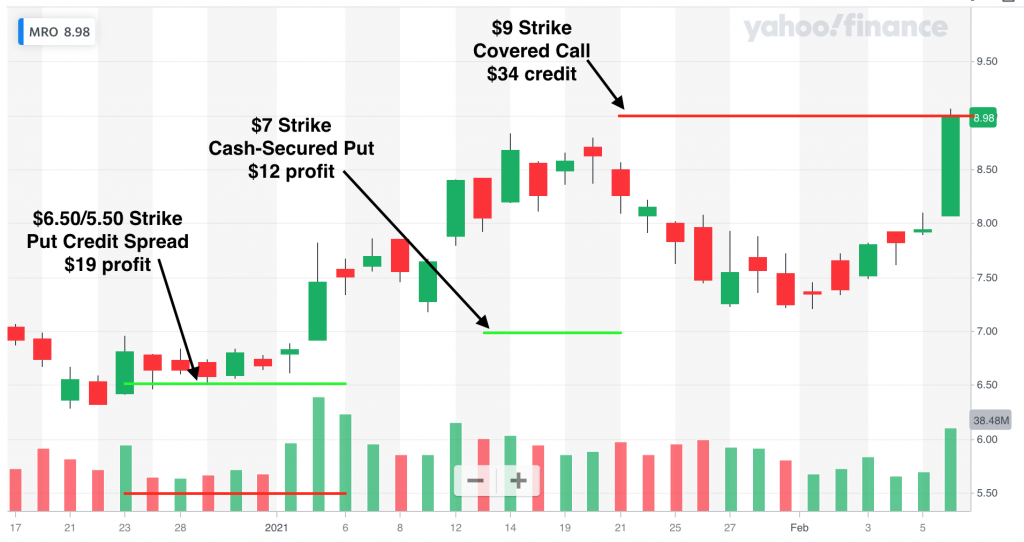

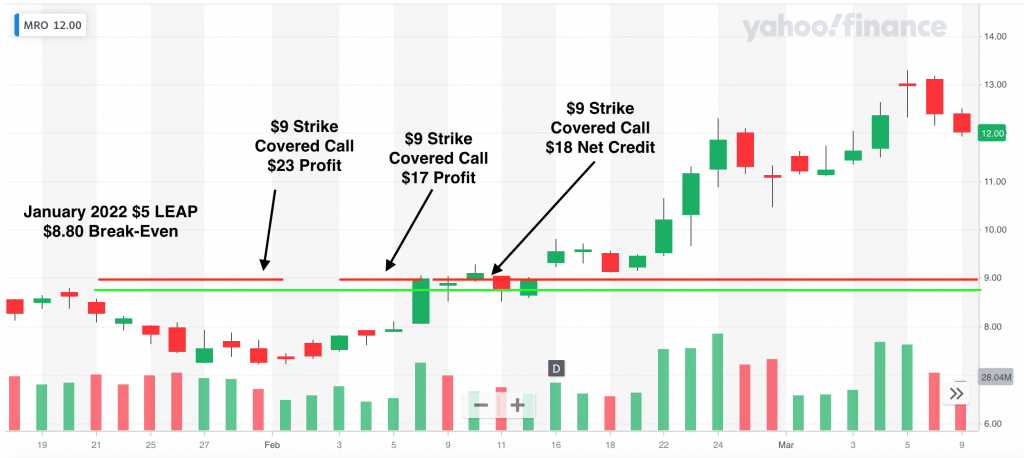

$MRO, 1 LEAP January 21, 2022 $5 Strike at a cost of $3.80; 1 March 12, 2021 $9 Covered Call. Last month I said I was going long on Marathon Oil Corporation because I thought demand for oil would increase as the World begins to open up from COVID-19. Well, I was right. Gas prices are up and $MRO has blown past my $9 strike! At over $12 it is now basically at pre-pandemic levels.

I closed my first covered call for a nice $23 profit. But then I should have moved the strike up to $9.50 so I could have had a little more appreciation. However, I was still able to make $17 on my next covered call when I rolled it out to my current contract. Unlikely that I will be able to continue collecting good premiums on this so I might have to let this one go in March.

Extra Mortgage Principal Paid

As I explained in January’s post, I don’t take my options trading profits and put all of it towards the mortgage anymore. Instead I spread it across a couple other investments that I think are very likely to beat my 3.125% mortgage APR in the long run. I now target just 1% of the beginning trading portfolio value each month. February started with a value of $3,514, so I rounded 1% up to $36.

In addition, my small but growing portfolio of preferred stocks paid out their first dividends, which totaled $1.33. So between the two, I put $37.33 towards the mortgage. I’ve now paid a total of $293.33 over the past five months, which will equal $450 in savings over the life of the loan.

Preferred Stock

My first passive alternative to directly paying off my mortgage principal is preferred stock. At the end of February, my preferred stock portfolio for this mortgage pay off strategy was worth $187.01 and consisted of seven different positions (8 shares total). I purchased three preferred stocks for the month, totaling $67.31. Here are my current holdings:

- CDR-C, 6.5% coupon with a yield on cost of 7.39%

- GLOP-A, 8.63% coupon with a yield on cost of 10.45%

- NRZ-A, 7.5% coupon with a yield on cost of 8.07%

- NRZ-B, 7.125% coupon with a yield on cost of 7.95%

- PEB-C, 6.5% coupon with a yield on cost of 6.95%

- PMT-B, 8% coupon with a yield on cost of 8.08%

- SCE-J (2 shares), 5.375% coupon with a yield on cost of 5.57%

February’s $1.33 in dividends came from $NRZ-A, $NRZ-B and $CDR-C.

Hedgefundie’s Excellent Adventure

This strategy is purely for capital growth. The target allocation is 55% UPRO/45% TMF, which are both 3x leveraged ETFs. Once their value is enough to reduce my mortgage term by one month, I will put it all towards the mortgage and start over. I have yet to rebalance this because the total value is still so small, but rebalancing is critical to this strategy’s success. For February, $15 was put into $UPRO and $17 into TMF. At the end of the month, the value in these funds was $88.01, which is actually a negative return on the $93 I’ve invested. Nothing to sweat at this point, I will just continue to buy more at lower prices. To reduce my mortgage by one month I would need to make a $573 payment, so still a long way to grow.

Accounts Summary

Of the $199 earned from options trading in February, $62 was set aside into the ULP for taxes, $37.33 was put towards the mortgage principal, $67.31 was invested into preferred stocks and $32 was invested into Hedgefundie’s Excellent Adventure. The remaining $3.02 will stay in my trading account. The trading account’s value ended January at $3,964.77, preferred stock was at $187.01 (with a forward yield of 7.35%) and Hedgefundie was at $88.01.

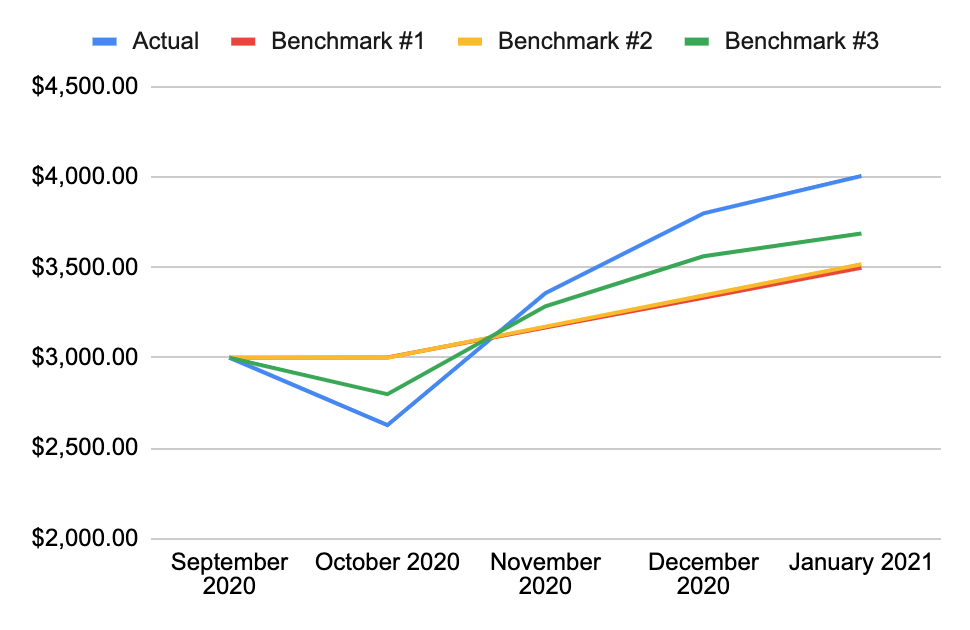

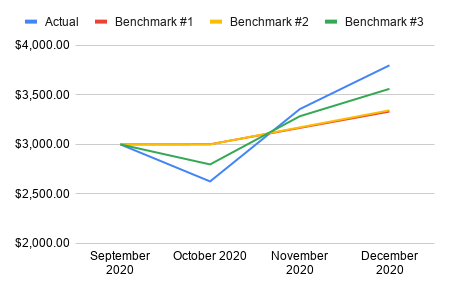

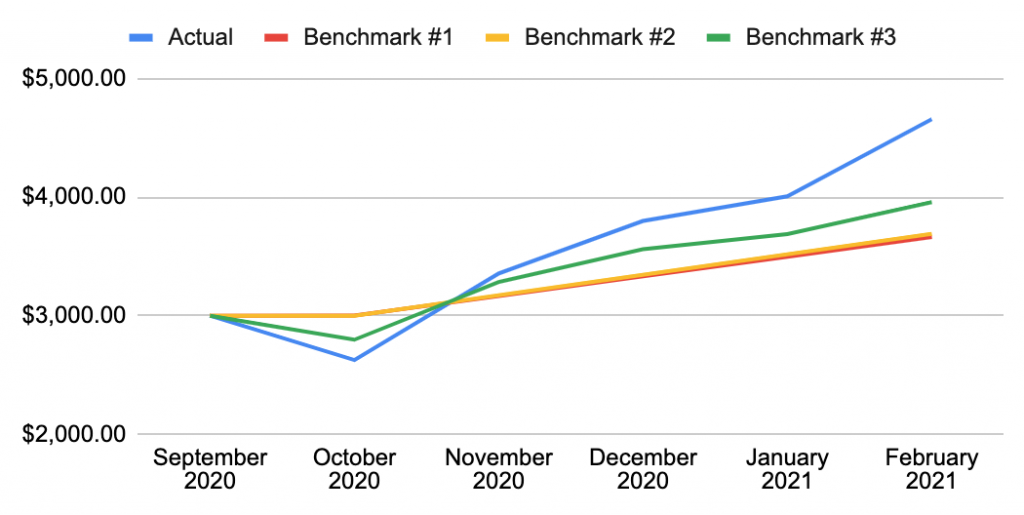

Benchmark Comparisons

In my introduction post I identified three different benchmarks I will be comparing my performance to. Benchmark #1 is putting all of my savings from my refinance, plus a 1 month skipped mortgage payment, into a savings account. When I wrote that post I was actually getting 0.6% APY, but it has reduced twice down to just 0.3% now. Benchmark #2 is putting all of those savings straight into extra monthly payments to the mortgage principal. Finally, Benchmark #3 is simply buying $SPY.

After 5 months I have invested $3,656.84 (initial $3,000 + $164.21 per month). Benchmark #1 is at $3,662.10, Benchmark #2 is at $3,690.78, Benchmark #3 is at $3,957.27. My actual total is at $4,656.27. I’m just shy of $1k total return at $999.43, or 27.3% (78.6% CAGR). My returns include the value of my principal in my trading account + the monthly contribution of $64.21 and interest into my savings + the difference between the original loan and what is actually remaining this month. My results are beating Benchmark #1 by 27.2%, #2 by 26.2% and #3 by 17.7%.

The market has had plenty of ups and downs the past couple months. I will keep plugging away and hopefully will be able to continue to outpace all three benchmarks!

Disclaimer: I am long $AAL, $MRO, $GE, $CDR-C, $GLOP-A, $NRZ-A, $NRZ-B, $PEB-C, $PMT-B, $SCE-J, $SPY, $UPRO and $TMF. I am not a financial advisor. This is not investment advice. Please do your own research before investing in anything discussed herein.