In my first month of using options trading profits to pay off my mortgage early, I earned a total of $152 and put $73 of that towards my mortgage principal. Over the life of the loan, that $73 is worth a total of $113. My goal as stated in my introduction post was to earn 1% of my initial $3,000 starting principal and put just $21 towards the mortgage principal. I was off to a great start, though my principal was down 16%.

I am very happy to report that my second month was even better than my first: $167 in profit! This is a 6.2% return on capital for the month of November (75% annualized).

Thanks to the overall market’s strong month, my long positions went up and I was able to completely reverse the 16% my principal was down. It is now at $3,240.86, which is 1.3% higher than the $3,200 I have added to the account thus far.

My positions & trades

$AAL, 109 shares at $13.98 ($1,523.73 total principal). Principal is currently up 2.3% ($34.97). I closed a total of four positions for a profit of $34. I currently have a $15 covered call position that I expect to collect another $34 from on New Year’s Eve.

$34 is a 2.4% return on my initial principal on American Airlines, well above my 1% goal each month, but much lower than the total portfolio’s returns of 6.2% for the month. The higher returns came from the other positions this month, but I’m happy to hold onto American Airlines for now. I think it will continue to move up and down with the COVID vaccine news, and I plan to ride that wave.

$FCEL, 100 shares at $2.34 ($233.78 total principal). At the close of November, Fuel Cell was trading at $10.18. That’s a 335% return! However, I sold a call option at $2.50, meaning my upside is limited to just $16, or less than 7%. Picking up pennies in front of a steam roller is a common metaphor used for selling options, and I think this is a perfect example of that. I plan to have a future post on this after it all shakes out. It will have a catchy title like, “How I missed out on $784.”

As for the trades, I had a $2.50 call option that I collected $15 on due to expire on November 20. Rather than letting the shares be called away, I decided to roll the $2.50 to the next month for a net credit of $10 (the November contract was bought for $1.55 and the December contract was sold for $1.65). This is basically a guaranteed $10, or 4% return on the $250 principal I would collect if/when the shares are assigned. For me to lose money on this, the stock would have to retreat all the way back below my purchase price of $2.34. I am now so far in the money that I’m not sure I will be able to continue to roll the position for a profit. However, I will still try as long as I can get 2% or so.

$M, no open position. Macy’s is another stock that I missed some big upside gains on. However, I was able to milk it a little more than the $FCEL trade. I closed two trades for the month, netting me $54 on a position size of $617, which is an 8.8% return. When I finally had the shares called away at $6.50 on November 20, I profited $33 on the sale, but missed out on an additional ~$250 since the stock was then trading near $9. The stock is now above $10. I most likely won’t enter $M again unless there is a pullback.

$GPRO, no open stock position. Go Pro was my third position that was called away this month. I had 100 shares at $6.46, and the shares were called at $7 on November 6. You can see in the chart below that there was a big spike that I got caught in.

In total I closed three trades for a net profit of $52. I currently have a $6.50 put due to expire this Friday, December 4. It is only an $8 credit, but that exceeds my 1% goal and was only a one-week contract. I expect to trade more cash-secured puts around the $6-$7 level going forward.

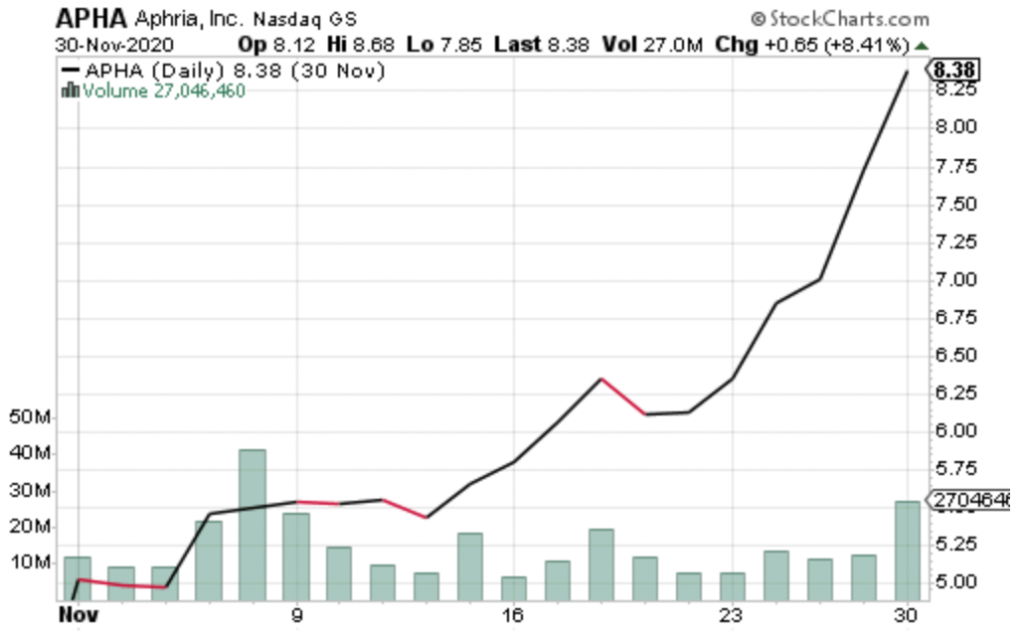

$APHA, no open stock position. Marijuana stocks are going nuts right now and option premiums are juicy. Aphria has been especially volatile due to a recently announced acquisition of Sweetwater Brewing Company. I currently have a $6.00 cash-secured put contract for December 11 that I collected a $17 credit on (2.8%). If I get assigned, I will sell a covered call in the $6.50-$7 range most likely.

Extra Mortgage Principal Paid

With $167 in net credits earned for the month, I am setting $53 aside for tax purposes. Last week I said I would be using $GNMA for my “tax escrow.” I have since been enlightened with the “The Ultimate Liquidity Portfolio” (ULP). I will have a forthcoming post on the idea as well as the book How to Stash that Cash by Chris Kawaja. In practice, the ULP can be implemented by putting 88% into intermediate term treasuries (e.g. $VGIT) and 12% in the US total stock market (e.g. $VTI). This puts my tax escrow account value at $99.82 as of this post.

So after taxes, I’m left with $114 that I decided to put directly towards my mortgage principal. With a combined $187 put towards my mortgage principal after two months, I will save $288 over the life of the loan.

Benchmark Comparisons

In my introduction post I identified three different benchmarks I will be comparing my performance to. Benchmark #1 is putting all of my savings from my refinance, plus a 1 month skipped mortgage payment, into a savings account. When I wrote that post I was actually getting 0.6% APY, but it has reduced to 0.4%. Benchmark #2 is putting all of those savings straight into extra monthly payments to the mortgage principal. Finally, Benchmark #3 is simply buying $SPY.

After losing to all three Benchmarks in my first month, I am now well ahead in all three. When considering the value of my principal in my trading account + the monthly contribution of $64.21 and interest into my savings + the difference between the original loan and what is actually remaining this month, my total value is at $3,356 after the month of November a 27.8% improvement over October. That beats Benchmark #1 (all savings) of $3167 by 6.0%, Benchmark #2 (extra mortgage payments) of $3,172 by 5.8% and Benchmark #3 ($SPY) of 2.2%. I’m pretty impressed that I managed to beat $SPY since November was the best month in the market in over 30 years.

I plan to put all these details onto my Using Options to Payoff My Mortgage Early page, including some tables and charts to show my progress from month to month. I’m still trying to format that so it’s easy to read, but hopefully I get that done before the end of the year!

Thanks for following along. I’m very happy with my progress, but it is just early days. Please don’t follow what I’m doing without doing your own research. Trading stocks and options can be risky. I hope you are inspired by these series of posts and my website to learn more about the strategies I am using to trade options and build wealth rather than attempting to follow blindly.

2 thoughts on “Using Options to Pay Off My Mortgage Early: Month 2”