The market had another strong month, though not quite as great as November. $SPY was up 3.3% in December, closing on New Year’s Eve at an all-time high. If I had told you there would be a worldwide pandemic and most of the world would shut its doors in 2020, I bet you wouldn’t have guessed the S8P 500 would be up more than 16% by the end of year? Crazy.

Since I’m just a few months into this blog, it doesn’t make sense to have a big yearly review of my performance in my accounts. I will review some changes I made this year, what I plan to do going forward, and some goals. But first, let’s wrap up December!

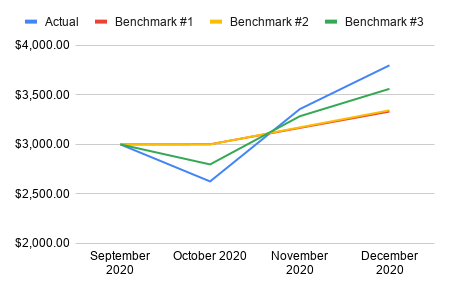

For the month of December, my total profits from options trading were $2,320.73, my best month yet and nearly 10% more than last month. That’s a total portfolio return of 2.1% and below the market’s 3.3% for the month. However, my total portfolio value across all accounts – which includes options trading profits, current stock & options positions, contributions & withdrawals for extra mortgage principal payments – was up 3.6%, just edging out the markets performance. The portfolios had net contributions of $246.30 for the month. I closed 69 options trades with a win rate of 97%*.

(* That win rate is a bit misleading because it doesn’t count positions that were assigned as losses. The only way I get a loss according to my tracking is if I close a position with a negative net credit. I took assignment on 5 trades. If those 5 are counted as losses, my win rate comes down to 90%.)

I continue to split my accounts between two strategies. One is to trade mostly credit spreads and naked puts in margin accounts and the other is to sell cash-secured puts & covered calls (i.e. “the wheel” strategy) in non-margin and IRA accounts. The goal for the margin accounts continues to be to 1) raise cash to increase trading capital and 2) run through my mortgage pay off strategy. The other accounts are reinvesting the profits into stock positions for future growth or passive income via dividend stocks.

Biggest Winner

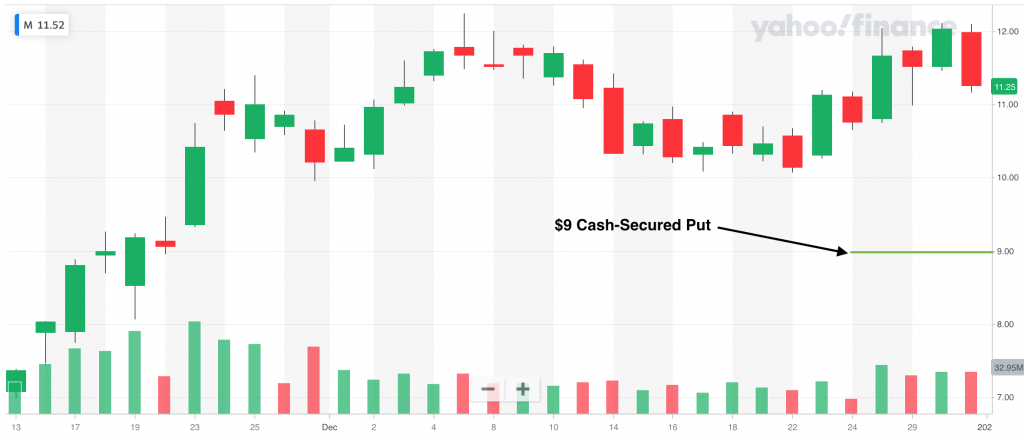

My biggest win of the month, and ever by total profit, was a cash-secured put on $LOW. Lowe’s has shown to be very resilient during the COVID shutdowns thanks to many people taking up home improvement projects (myself included! In fact, I swiped my Lowe’s credit card countless times in 2020). There was a big pullback on November 9 and I decided to open the December 18 cash-secured put at the $150 strike for a credit of $3.75. At one point I was in the money, but held my ground and let it ride, knowing that if I was assigned I would be happy to own $LOW at $150. About a week before expiration the stock jumped back up and I took that as an opportunity to close the trade for a net credit of $340.68, a 2.3% return (25.1% annualized).

Biggest Loser

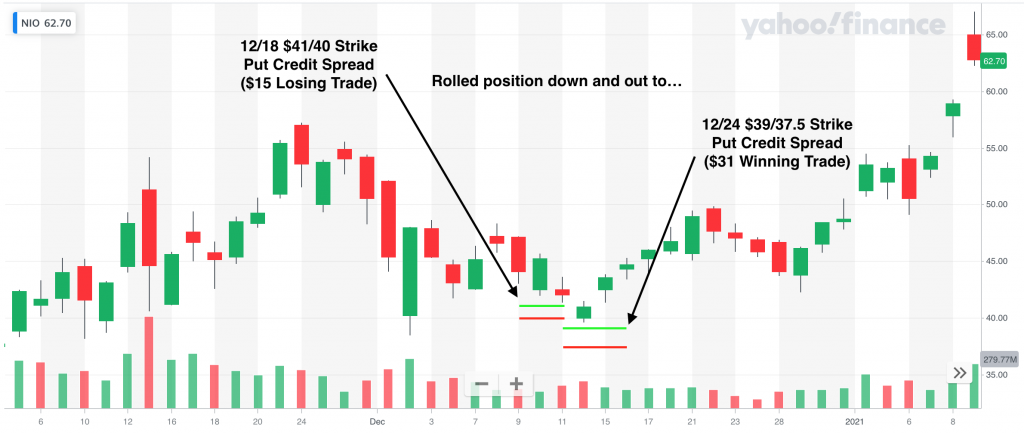

My biggest loss was on Chinese EV company $NIO. The loss was only $15, and looking at the chart below, would have been a winner if I had held until expiration. It was a Put credit spread for December 18 expiration at the $41/$40 strike. I opened the trade on December 9. The stock started moving against me, and rather than holding the line, I decided to roll out one week and down a bit. I also increased the width of the credit spread, allowing me to bring in some credit for this trade. I ended up with the December 24 expiration now at the $39/37.5. Once the stock began moving in my direction, I decided to let it go and pocket a $31 profit. So net was a positive $16. Not bad for my biggest loser!

My biggest paper loss by far was on $FCEL as I wrote about here: Picking Up Pennies In Front of a Steamroller: Covered Call on $FCEL. At expiration, I was “down” $680! Because this was a covered call, it is more of profits missed rather than an actual loss.

I had an actual paper loss due to an assignment on $PFE at expiration. I had a cash-secured put at the $41 strike. At expiration, $PFE was trading at $37.68, so the paper loss was $332 ($41-37.68). I did collect $102 in credit, so net is a loss of $230. Pfizer is obviously a very strong company and am not worried holding a long position. I will sell covered calls at above $41 and collect premiums until I get assigned. Currently I have the February 19 expiration $42 covered call for a net credit of $64. If I hold it until expiration, that is a 9.2% annualized return. In addition, Pfizer currently pays a dividend of ~4%, which I will collect until the shares are called away.

Looking forward to 2021

In my first few months of options trading I’ve had some really great success. While I’m not about to retire from my day job and go YOLO on selling options, I do see potential to make this sort of a side hustle. One thing I am realizing, and one of the things I am drawn to, is it is not at all a passive form of investing — at least not the way I’m doing it! I do, however, believe that passive index investing is a great strategy for building wealth and that is what my wife and I are doing in our 401k’s.

With that said, here are some of my investing related goals for 2021 (in no particular order):

- Contribute $6,000 to my ROTH IRA. I opened my ROTH towards the end of 2020. With $12,000 in the account I should have some good options for… options trading.

- $10,000 in non-W2 income. This includes profits from options trading, dividends, interest, etc. only in my taxable accounts. This is pretty aggressive, and definitely a stretch goal. Last month was my best month of option trading profits yet at $620 for the month in those accounts. I will need to average $833 per month.

- Build $100/month in passive income, primarily from dividends. Again, this is in my taxable accounts. The goal isn’t to have $1,200 in dividend income for the year as I think that is too aggressive for me at this point, but to be averaging $100/month as I go into 2022 (or $300/quarter since most stocks pay out quarterly). I haven’t added up all the numbers, but I was probably around $60/month in 2020. I might start including dividend income in my monthly updates.

- Increase our 401k contributions. We certainly won’t be in a position to max out both of our 401k’s this year, but I’d like to get there over the next few years.

- Increase net worth by 30%. This one is also a bit of a stretch goal. As we become more invested each year, net worth increases will become more subject to market conditions and less due to our savings. We benefited from being able to put more into the market in March and April of last year, and it’s unlikely we will have another opportunity like that. But who knows! We ended 2020 up 32%.

- Reduce mortgage length by 1 month. As a part of my mortgage pay off strategy, I’m hoping to be able to pay enough towards the principal to reduce the length of my loan by one month. As of this month, I need to put another $643 towards principal to accomplish this. At my current rate of monthly progress, that would take less than 6 months to achieve. However, I’m not putting quite as much directly towards the mortgage as I did the first two months. In the long run it will “pay off”, but may make this goal more difficult to achieve in 2020.

Onward to 2021!