After a terrible month of returns in Month 9 (thanks to betting against $AMC!), I was able to right the ship a bit and post positive returns for July and August. The S&P 500 keeps humming along, however, and I’m now trailing the benchmark I’m measuring against of dollar cost averaging into $SPY.

In July a collected $157 in premiums (3.92% return on trading capital) and in August I collected $184 (4.51% return). In addition, at the start of September my trading capital is now back above the total contributions into the account ($4,108.52 vs total contributions of $4,100).

As I try to wrap things up for two months at a time, no detailed trade positions in this month’s update. I will say, however, I have a few PMCC’s (tastytrade description) open in $F, $MRO & $ZNGA; I continue to roll my $18-strike ITM covered call on $AAL; and I’m back to trading quite a few put credit spreads.

Beginning in July I got an exciting notice from my mortgage company that they have reduced my monthly escrow payment by $34.50, which increases my monthly contribution to $198.71 now! I’m excited to grow this into more returns.

Extra Mortgage Principal Paid

For July I made a major switch from putting a portion of my option trading profits for the month directly towards the mortgage. I now have several buckets going, with each bucket having its own strategy for deposits and withdrawals. I’m continuing with taking out 1% of my option trading account balance, but now that is going back into my money market account rather than directly towards mortgage principal. The balance in the money market then determines how much goes towards the principal, as well as 1/300th (4% annual) from my risk parity account and dividends from my preferred stocks. Lots of moving parts, but those following along know I’m not afraid of complexity!

For July’s principal payment, $1.04 came from my risk parity account (using 4% annual withdrawal rate); $.90 came from dividends paid from preffered shares; and $2.55 from my money market account (using account balance / CFI of mortgage payment); for a total of $4.49.

For August’s principal payment, $1.15 came from my risk parity account; $1.36 came from dividends paid from preferred shares; and $3.02 from my money market account; for a total of $5.53.

I have now paid an additional $455.16 towards the mortgage principal, which will save $692.91 in interest over the life of the loan.

Risk Parity

At the end of August, my risk parity style account was up to $346.11.

Benchmark Comparisons

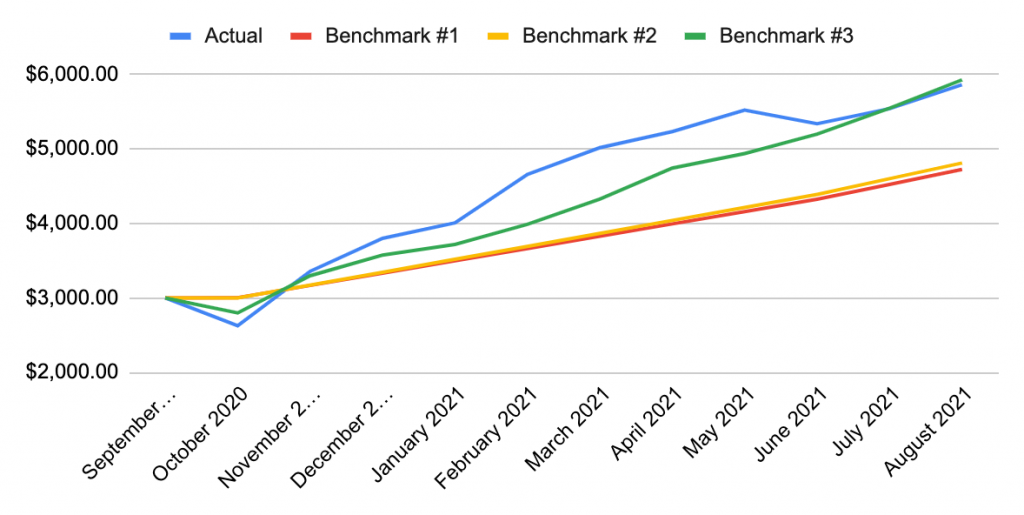

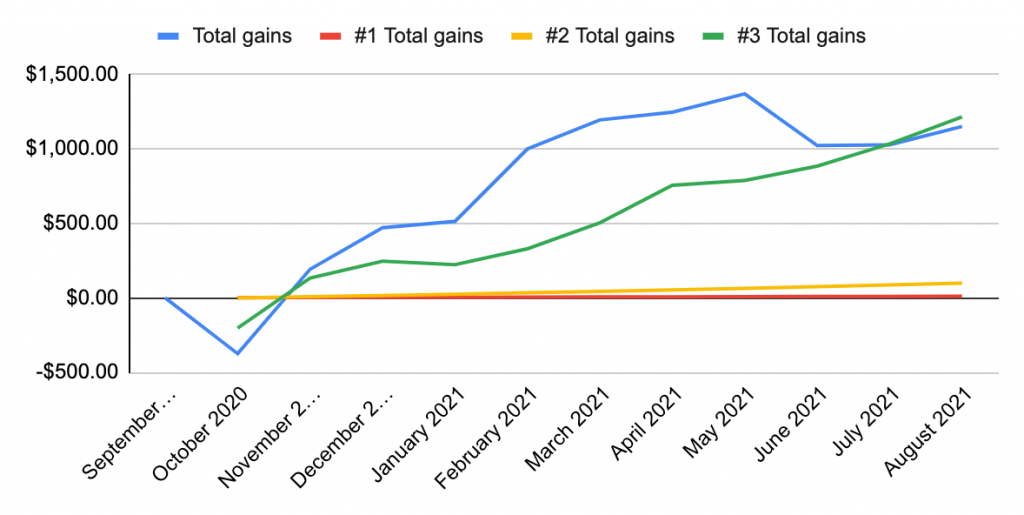

In my introduction post I identified three different benchmarks I will be comparing my performance to. Benchmark #1 is putting all of my savings from my refinance, plus a 1 month skipped mortgage payment, into a savings account. When I wrote that post I was actually getting 0.6% APY, but it has reduced twice down to just 0.3% now. Benchmark #2 is putting all of those savings straight into extra monthly payments to the mortgage principal. Finally, Benchmark #3 is simply buying $SPY.

After 11 months I have invested $4,711.10 (initial $3,000 + $164.21 per month or $198.71 for months 10 & 11). Benchmark #1 is at $4,722.48, Benchmark #2 is at $4,809.61, Benchmark #3 is at $5,925.05. My actual total is at $5,860.53. Total return is now at $1,149.43, or 24.4% (26.9% CAGR). My returns include the value of my principal in my trading account + the principal in my money market account + balance of preferred shares + balance of risk parity account + the difference between the original loan and what is actually remaining this month. My results are beating Benchmark #1 by 24.1%, #2 by 21.9% and trailing #3 by -1.1%.