Almost immediately after the COVID-19 pandemic struck, Ford announced that it suspended its dividend. This was unfortunate news for me since I had been accumulating shares over the previous 6 months, having been allured by the 6%+ yield Ford was providing at the time in this yield-starved world we continue to find ourselves in. After wetting my lips with a couple tasty quarterly dividend payments (which I reinvested), the stock tanked from the $12 range to a 52-week low of $3.96 on March 23. I accumulated a few more shares here and there to lower my cost-basis, but without the promise of a dividend, my thesis on the company was broken. I wasn’t in it for the growth potential after all (most car companies that don’t end in “ESLA” have limited growth potential, in my opinion), I just wanted that dividend!

But then the stock started creeping back up as car sales proved to not go to zero as many feared during the varying levels of shutdowns we have seen throughout the US. Around this time I began trading options and immediately found an opportunity here with Ford. I began writing cash-secured puts below the market, using premiums earned to purchase shares and continue to lower my cost-basis, following the stock steady move up past $6, $7 and now $8. With my cost-basis now at $8.86, I’m nearly back to even with the stock closing at $8.75 at the close on Tuesday, November 17. I now find myself at a point where I can’t lower my cost-basis further by buying shares at the market price and I’m not interested in investing more capital, especially while there is still no dividend on offer. I still think there is a bit more upside to the stock, however, so I’m also not interested in selling at this point.

Creating my own dividend

I read this article on Seeking Alpha and was inspired to write this post. Rather than sitting on my hands while I hope that Ford resumes their dividend, I will be selling covered calls instead, essentially creating my own dividend. With my cost-basis at $8.86, I can now sell covered-calls at any strike price from $9 and above and still guarantee a profit in the event the shares get called away. I plan to sell the calls at least one strike price above the current trading price, as long as the premium I receive is above that 6% annual yield I was initially after. I would also like the credit I receive, less fees, to be more than the current trading price so that I can reinvest the credit just like I would with a standard DRIP.

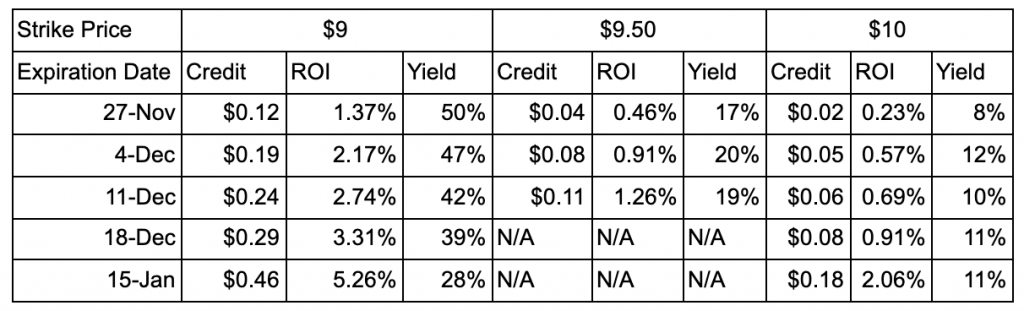

Below is a table of credits I could receive for selling calls at various strike prices and expiration dates. These credits are subject to market conditions, so they change constantly. However, they generally move up or down in unison, so I find this to be helpful in comparing my different covered call options.

With these data points known, I’m leaning towards selling the December 11 $9.50 call.

Downsides

Like any options trading strategy, there are risks and downsides associated. I’m going to briefly review some of them.

Stock drops

If the share price drops, I get to keep the credit I received up front, but my underlying shares of $F will have gone down. I got a return on my investment, but my principal is now diminished. I get to sell another call after expiration, hopefully at a still-attractive strike price/credit. This is still a risk even if I had not sold a call option and I was just waiting patiently for my dividend.

Shares get called away

If the shares go above my strike price, the shares will get called away at the strike price. Again I get to keep the credit I received up front AND I sell the shares for a profit since I picked a strike price above my cost-basis. If $F rips several dollars higher than my strike price, then I will have some FOMO for not getting to participate in the full upside. Such is the plight of option sellers.

Taxes

Besides losing some of the potential upside by writing a covered call, I am also increasing my taxable income with every option contract sold. I am doing these trades in a taxable account. If Ford was still paying a dividend, I would be collecting qualified dividends and therefore only being taxed as a capital gain (which 15% for my income bracket). Credits from option trading, however, are taxed as ordinary income (over 30%). While this is a factor to consider, I would rather pay taxes on income that I wouldn’t have had otherwise.