It’s been two months since my last update on my covered call strategy on $F while I wait for a dividend to be reinstated. As outlined in my first post, the ~6% dividend Ford was offering in 2019 was the primary reason I started accumulating shares. With the COVID “crash” in March the dividends were “suspended” while the company stabilized. That was probably the correct move for the company’s longterm future, but that doesn’t mean I didn’t miss those quarterly payments!

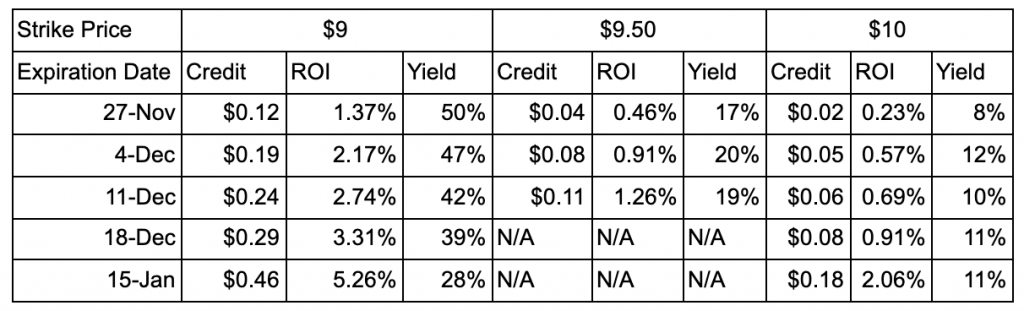

With that in mind, I started selling covered calls at strike prices above my average price to generate some income on that tied up capital I had in Ford. As the share price has rebounded, I have found myself in the money on my positions, but I have still been able to roll them out for an acceptable rate of return.

As of my last update, I had two February 19 covered calls, one at $9 strike and $10 strike. I had taken in $67 in credits before commissions. $F is now trading in the mid-$11s. Since then, I have been able to roll both of those out to March for another credit.

On January 22, I rolled the $9 covered call out to March 19 for a net credit of $16.68. This is a 1.9% return over 57 days, which is 11.9% annualized. With that credit, I bought one additional share for $11.47. This is similar to a DRIP (Dividend Reinvestment Program) with a traditional dividend.

On February 2, I was able to roll the $10 covered call out to March 19 expiration for a net credit of $31.68. This is a 3.2% return of 46 days, which is 25.1% annualized! As of now, I haven’t reinvested that credit and have just kept the cash.

This brings the total net credits from selling covered calls to over $115. At a current share price of $11.58, that’s a return of 5% over the course of about 3 months.

These positions, especially the $9 strike, are sitting pretty far in the money at this point. This means that there is very little extrinsic value remaining in these contracts, which means sooner or later I will choose to let it expire at have the shares called away. Fortunately, I have more than 200 shares of $F that I’ve own for more than 1 year, so my gains on those shares will be taxed at longterm capital gains if I’m forced to sell when they’re called away (to be clear: all the credits I’m receiving for selling the covered calls are taxed as ordinary income, unfortunately). If the stock price sees a pullback down below $11 again, I will look at rolling these out again as it’s likely there will be some more extrinsic value again. As long as I can get a 1% net credit for rolling out between 1 to 2 months, I think it will still be worthwhile as that’s a 6-12% annual return that, I feel, is pretty low risk.

I do expect Ford to resume the dividend at some point, so it would be nice if I could continue to roll out until then. But if Ford continues to climb higher and I get further and further in the money, that becomes increasingly unlikely. Either way, I will continue to update the blog with what happens.

Follow me on Twitter to stay up to date on my latest posts.

Disclaimer: I am long $F. I am not a financial advisor. This is not investment advice. Please do your own research before investing in anything discussed herein.