First off, HAPPY NEW YEAR! This is not a yearly recap post and since I just started this blog a couple months ago, I’m not sure I will be making one. I will likely have a forward looking 2021 post though. Now, onto the post…

After two months of this experiment, I had put a total of $187 towards my mortgage principal from options trading profits which will equal $288 of interest saved over the course of my 30-year 3.125% loan. In addition, my options trading account principal of $3,200 (which was/is funded from savings from refinancing) was up to $3,240.86. A great start and already ahead of my initial goal by 2.6%.

I have continued to outperform in December, my third month, with $170 in options trading profits which is a 5.1% return on capital! In addition, my principal has grown to $3,498.35, 6% more than the $3,300 added to the account thus far. Remember, that 6% is after deducting taxes and withdrawals from the account to make the extra mortgage principal payments.

This month I have made a dramatic tweak to how I am divvying up my options trading profits towards my extra mortgage principal payments. More on that after I review this month’s positions and trades.

My positions & trades

$AAL, 100 shares at $13.98 average ($1,398 total principal). Principal is currently up 15.4% ($215.08), however I currently have a $15.50 covered call position expiring on January 29, limiting my capital gains to $152 total. I closed two positions for the month and for a profit of $74. I collected a net credit of $12 after rolling up from a $15 strike position to the current $15.50 position.

Going forward I will most likely continue to sell the $15.50 strike even if it stays in the money. I should be able to collect a large credit at least one more time. I will consider moving up to the $16 strike if I can still collect a decent credit. My main objective here with this account is to generate income, with a secondary goal of capital preservation and tertiary is capital growth, however I don’t want to leave easy money on the table in the name of current income. Like so many things in life, it is a balance.

$FCEL, no open positions. This month I finally had my shares of FuelCell Energy called away. In the end, I made about 30% in profits from that position. BUT I missed out on a $1,000 profit! This was a classic case of picking up pennies in front of a steamroller. In my defense, the pennies were very shiny and no one could have seen that steamroller coming!

I only closed that final $2.50 covered call for a $10 profit. On to the next one!

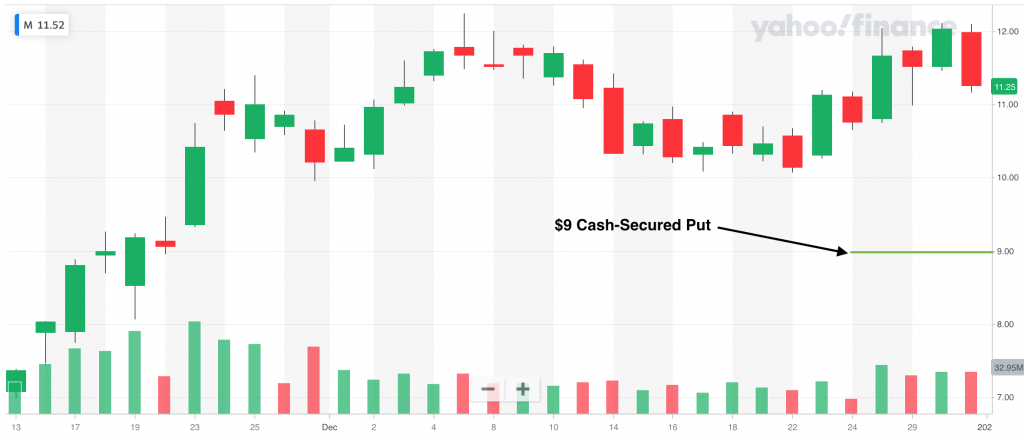

$M, no open stock position. Last month I had my Macy’s position called away at $6.50. I had just about given up on the stock when I saw an easy trade by selling a $9 Put for January 15 for a credit of $15. This trade is a 1.7% return (26% annualized), so it meets my 1% goal.

If the stock drops suddenly to below $9 and I am assigned, I expect the premiums to go up and good potential for selling covered calls.

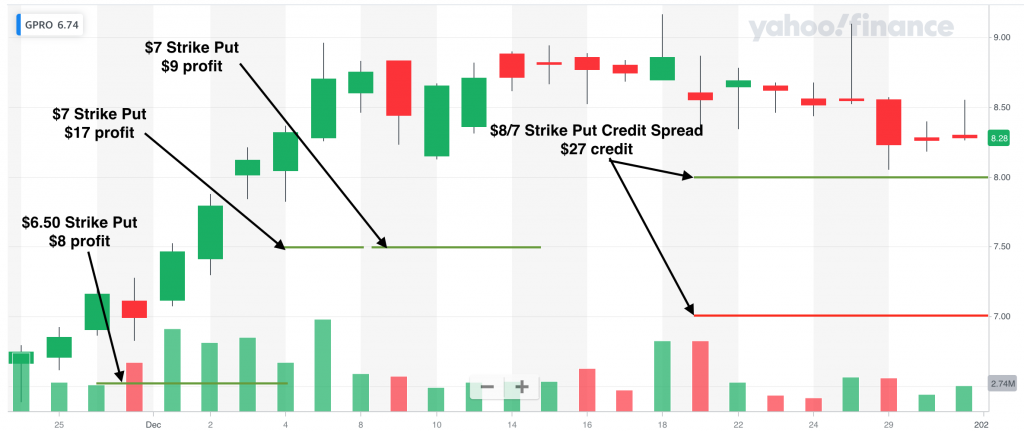

$GPRO, no open stock position. Similar to Macy’s, Go Pro was a stock that was called away from me in November. I decided to sell some puts this month, and that worked out well for me. I closed three positions for $34 profit. My highest strike price on those positions was $7.50, so that $34 was made using $750 as collateral, which is a 4.5% return.

I currently have a put credit spread at the $8/$7 strikes that I collected a credit of $27. In the past couple months I have had a lot more success with simply selling naked positions (cash-secured puts or covered calls, technically) than with credit spreads. However, more recently I’ve found some decent success with credit spreads as long as I’m willing to roll it out when I’m challenged. Contrary to a lot of advice, I am generally able to do this while collecting a credit if I widen the spread. So if I start with a $1 spread, I roll it out and down (for a Put) or up (for a Call). I’m therefore increasing my potential loss, which is why it generally isn’t advised, but it’s working for me right now so I’m going to go with it.

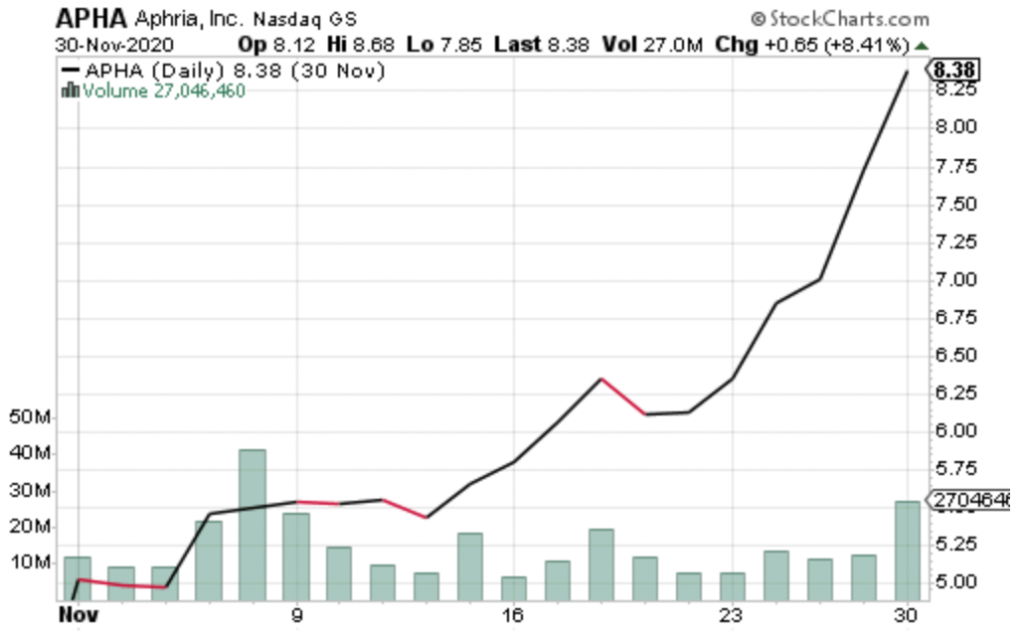

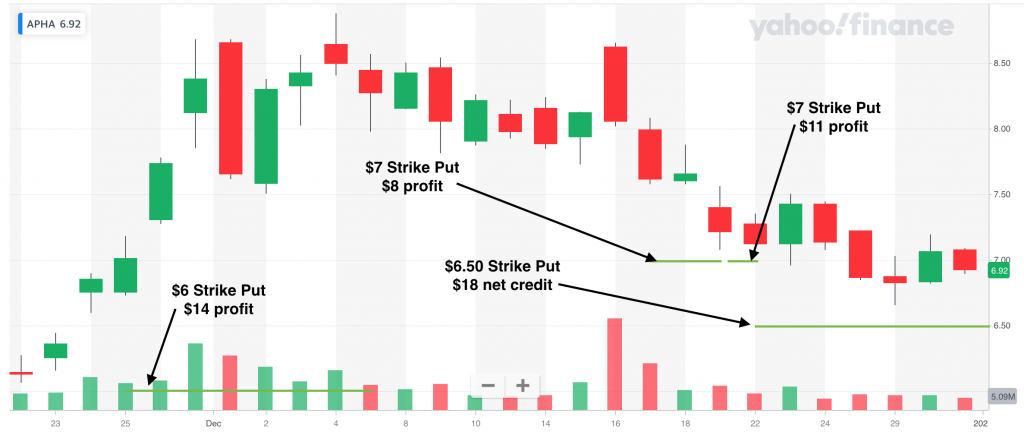

$APHA, no open stock position. I continued selling cash-secured puts on Aphria this month for some decent profits. I’ve thus far avoided getting assigned the stock. I closed three positions for a total profit of $33. Similar to the $GPRO puts, those $33 were earned with a maximum collateral used of $700, so a 4.7% return.

I currently have a $6.50 cash-secured put for January 15 open that I am watching closely. I collected a net credit of $18 after rolling down and out from December 31 $7 strike. That’s looking like a pretty smart move since it closed at $6.92 on New Year’s Eve and I would have been assigned. I may look to roll down and out to the $6 strike if I am able to for at least a 1% credit (i.e. $6).

$MRO, no open position. I had one trade on Marathon Oil Corporation this month, a credit spread from $5.50 to $4.50, with a profit of $9.

$MAC, no open stock position. I have an open credit spread on The Macerich Company (a REIT) from $9 to $7.50. I collected a credit of $13.

Extra Mortgage Principal Paid

As I said earlier in the post, I’ve changed how much of my profits I am putting straight into my mortgage principal. Perhaps this deserves its own lengthy post, but essentially I am wrestling with the opportunity cost of locking those profits up into the equity in my home. Now don’t read this as my giving up three months in.

As I listen to more finance podcasts and Youtube videos, I often hear about the velocity of money. When money is moving, it has velocity. Option trading is great because you are constantly moving money from one opportunity to the next. The money has velocity. When a dollar goes into my mortgage principal, it comes to a screeching 3.125%-halt. Remember my goal, which I am currently outperforming considerably, is 1% a month or 12% a year! Wouldn’t it be great if I could keep the velocity going before slowing it way down with my mortgage?

Of course it would be. However, the only reason anyone ever put extra principal into a mortgage was for that guaranteed rate of return. It’s essentially risk free! Compare that to a 0.4% APY “high yield” savings account and that 3.125% rate now looks pretty good! Based on my performance in the past three months, I should sell options with every dollar I have since my returns are so great, right?! Well, no. I’m not so naive to think that this will continue on forever without any losses.

All this to say that I will continue to remove my profits from my mortgage payoff trading account. I will continue to set aside the correct amount for taxes. Assuming I am left with more than my 1% goal for the month, I will take that 1% and put it towards my principal. The remaining balance is where I plan to… diversify.

Preferred Stock

I’m not going to take the time to explain the nuances of preferred stock here (Investopedia definition). It is often referred to as a hybrid of stocks and bonds. Anyway, I have been reading a book called Preferred Stock Investing and I believe there are some great opportunities for some fairly high yields. This month I actually bought two preferred stocks with dividends that yield an average of about 8%. I plan to take those dividends and put that money into the mortgage principal. Instead of taking my super high return from options trading and slowing it down immediately into my mortgage, these dollars will keep speed for a while longer.

While I expect (hope) to outperform even these high yields of 8% with my options trading, these income source has the benefit of being nearly completely passive. Options trading is one of the most active forms of trading, I am learning. Diversifying profits away from the options trading and into more passive income streams will help keep everything more sustainable as the account size grows.

Hedgefundie’s Excellent Adventure

Honestly, not really sure where to start with this. Think leverage. Think risk parity. That’s Hedgefundie’s Excellent Adventure. The strategy, specifically, is 55% in a 3X leveraged S&P 500 ETF $UPRO and 45% in a 3X leveraged long term bond ETF $TMF. Rebalance as required. There’s a great write up of the strategy here (it initially started from an epic thread on the “Bogleheads” forum).

After setting aside my portion straight towards the mortgage and purchasing any preferred stocks for the month, I will split my profits 55/45% into the Hedgefundie strategy. For now, my plan is to let this pile grow until I reach enough to reduce my mortgage term by one month. As of now, I need $643. This allows me to benefit from the great growth potential of leveraged ETFs while minimizing the risk since I won’t be letting it grow indefinitely.

So how did I slice this complicated pie this month?

After taxes ($53 into ULP), the $170 profits was $117 net. Instead of putting that $117 total into the mortgage as I would have in the previous two months, I put just $33, which is ~1% of my account’s starting principal of $3,240.86 for December. I bought two preferred stocks ($NRZ.A for $23.22 and $PMT.B for $24.75) for $48.15. Finally, I invested $36 into the Hedgefundie strategy, as $20 in $UPRO and $16 in $TMF.

With a combined $220 put towards my mortgage principal in three months, I will save $338 in interest over the life of the loan. In addition, my preferred stocks are now worth $49.55, a 4.2% return, and will yield ~8% going forward ($3.88 in dividends annually). Finally, the Hedgefundie’s Excellent Adventure is also up 4.2% to $37.53.

Benchmark Comparisons

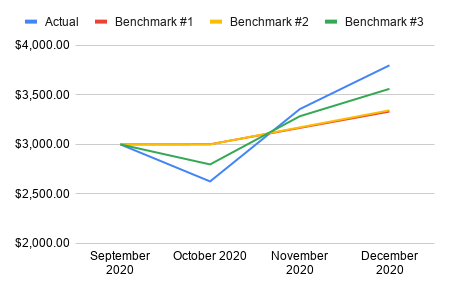

In my introduction post I identified three different benchmarks I will be comparing my performance to. Benchmark #1 is putting all of my savings from my refinance, plus a 1 month skipped mortgage payment, into a savings account. When I wrote that post I was actually getting 0.6% APY, but it has reduced to 0.4%. Benchmark #2 is putting all of those savings straight into extra monthly payments to the mortgage principal. Finally, Benchmark #3 is simply buying $SPY.

I continued to make gains across all three benchmarks this month. When considering the value of my principal in my trading account + the monthly contribution of $64.21 and interest into my savings + the difference between the original loan and what is actually remaining this month, my total value is at $3,799 after the month of December, a 13.2% improvement over November. That beats Benchmark #1 (all savings) of $3,332 by 14.0%, Benchmark #2 (extra mortgage payments only) of $3,344 by 13.6% and Benchmark #3 ($SPY) of $3,561 by 6.7%. Below is a chart of my progress so far.

Thanks again for following along. Looking forward to more progress in 2021!

Disclaimer: I am long $AAL, $UPRO and $TMF. I am not a financial advisor. This is not investment advice. Please do your own research before investing in anything discussed herein. This post contains affiliate links.