November was an incredible month for the markets. The S&P 500 rose 10.8% for the month and hit an all-time high. The Dow Jones’s 11.8% return for the month is the best single month since January 1987!

Because of my option writing (aka selling) strategy, my option trading returns weren’t able to beat the market. However, a large portion of some of my portfolios remain heavily invested in the markets, which keeps me from feeling too much FOMO and giving me the confidence to continue on with this strategy. I’m looking for lots of base hits here, from month to month. Over a long period, I think I can outperform the market, but only time will tell.

For the month of November, my profits from option trading were $2,114. That’s a total portfolio return of 2.3%, which is well below the S&P 500’s 10.8%. My total portfolio value across all accounts – which includes options trading profits, current stock & options positions, contributions & withdrawals for extra mortgage principal payments – was up 10.7%, inline with the markets. Contributions to these accounts were small this month, and $114 was withdrawn, so actual return is probably right around 10%. Remember that the markets were down 2.5% last month, and I generated options trading profits then, too. I closed 71 trades with a win percentage of 91%.

I continue to split my accounts between two strategies. One is to trade mostly credit spreads in margin accounts and the other is to sell cash-secured puts & covered calls (i.e. “the wheel” strategy) in non-margin and IRA accounts. The goal for the margin accounts continues to be to 1) raise cash to increase trading capital and 2) run through my mortgage pay off strategy. The other accounts are reinvesting the profits into stock positions for future growth or passive income via dividend stocks.

Last month almost half of my profits came from my margin accounts despite being just 11% of the total portfolio size. Many of my non-margin accounts had longer holding periods with expiration dates further out, so I realized a lot more profits in those accounts in November than I did in October. As a result, 84% of the profits came from the non-margin accounts this time. The margin account profits were a 3.7% return on total capital (43.1% annualized) and the non-margin profits were a 2.1% return (24.7% annualized).

10% is often cited as the historical annual performance of the S&P 500 since the 1920’s. Every month that I am beating that annualized return with options trading profits (and I crushed it this month with a combined 27.4% annualized return) and my total portfolio value is roughly inline with the overall market when it’s up (which I was within by about 1%), that’s a huge win. Just a couple years of this type of performance will have huge effects in my family’s longterm wealth creation. Let’s see if we can continue!

Biggest Winner

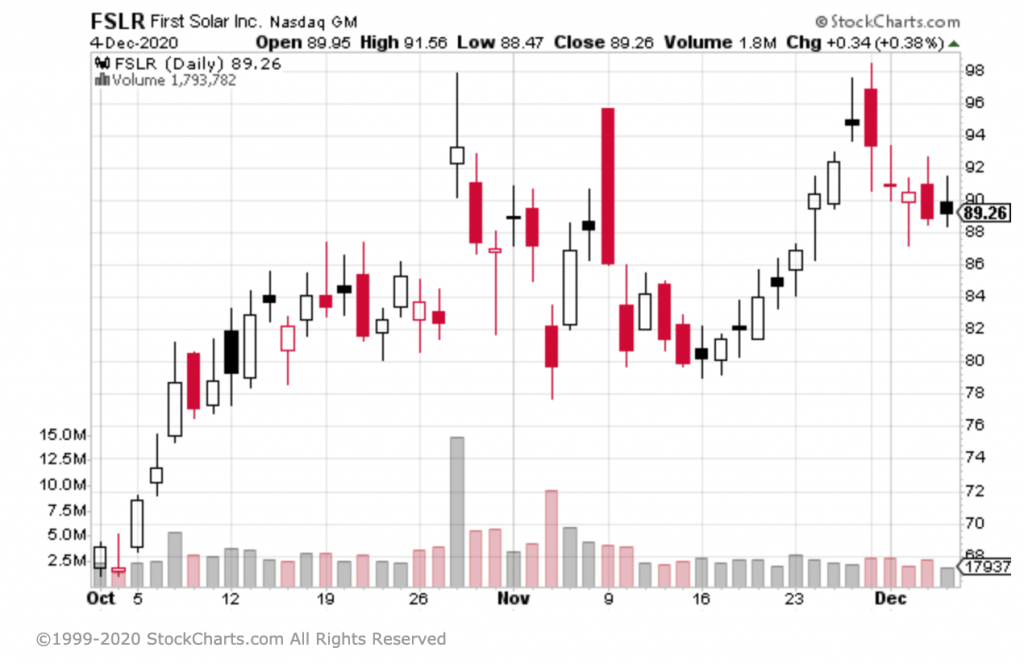

My best trade for the month in terms of profit was a wide Put credit spread on $FSLR. First Solar has been moving a lot over the last few months so the option premiums are really good. My original intent was to sell a cash-secured put (“naked put”), but decided I wanted to take some of the risk off the table so went with the spread instead. On November 13 I sold the $76 strike December 4 Put for a $2.04 credit and bought the $65 strike December 4 Put for $.35, giving me a net credit of $1.69 before commissions. When the stock moved up shortly after, I decided to close the position to lock in most of the profits on November 20. After commissions, I ended up with a profit of $130.36 on a 7-day trade which is an 11.9% return (541% annualized).

With the initial credits I actually purchased 1 share of $FSLR for $80.30, which is now up 11.9% to $89.26.

Biggest Loser

My biggest realized loss was $52 on a Call credit spread on $SPY. On November 2 I sold the $348 strike December 2 Call for a $3.57 credit and bought the $349 strike Call for $3.26, for a net credit of $31 (commission free trades with Robinhood). This trade had a 74% chance of profit when I placed it, making the $31 possible gain with a $100 risk worthwhile. However, the market went way against me and I decided to cut my losses early on November 9 for a $52 loss. In hindsight it was the right move because the market just kept going and going, so I saved myself another $17 in potential losses ($100 risk – $31 credit – $52 loss = $17).

This trade was part of a strategy I coined “ETF Challenger” that I mentioned in previous posts. Essentially I am challenging the ETF to continue moving in the same direction when it made a greater than 1% move. So when $SPY is up more than 1% on the day, I sell a Call credit spread above it near the .30 delta (Investopedia: Understanding Position Delta). If it’s down more than 1%, a Put credit spread. I’m seeing just as many losers as winners on this, so I’m probably going to be ditching it going forward.

My biggest paper loss is actually much worse than $52. I sold the November 20 cash-secured Put on $GOLD at $27.50 for a credit of $.30. At expiration, the stock was trading down at $24.28, so I was assigned the 100 shares at $27.50 and immediately had a paper loss of $292 (+$30 – $2,750 + $2,428 = -$292). Unfortunately $GOLD has continued to pullback to $23.50 currently. I took in a small credit $7 credit for selling a December 18 $28 covered Call, which makes my current paper loss at $363 (+30 +7 – $2,750 – $2,350). I’m going to be patient with this one and continue to sell covered calls above my originally assigned price of $27.50. This position is in an IRA, so when I look at a horizon over many years I expect there to be an instance where I will want the hedge against the market in gold (while $GOLD is actually a mining stock, it generally moves in the same direction as the price of gold).

Funding ROTH IRA

My last update for the month of November is that I finally funded a ROTH IRA! My wife and I are still under the household income limits for funding a ROTH, but I hope and expect that to no longer be true at some point in the future. I’m hoping to be able to fund that account with the maximum limit of $6,000 until we no longer qualify.

The obvious benefit of a ROTH over a traditional IRA is that future withdrawals are tax-free. Because of this, I’m hoping to create a stream of dividend income that can grow to a sizable amount at age 59.5. At that point, we will be able to take those dividend payments out each month/quarter and pay no taxes on them! For now, I’m planning to build the portfolio with REITs. My first trade: a cash-secured put on Realty Income $O, of course!

The second benefit I like about funding a ROTH is that, since contributions have already been taxed, they can be withdrawn at any age without penalty. It can essentially be used as a savings account where the principal is always available but the interest can’t be touched until age 59.5. My wife and I are keen on getting more involved in real estate, which means we will have a need for capital at some point in the future. By funding the ROTH rather than putting more money into a traditional IRA or regular 401k, we aren’t giving up control of that money for the next 30+ years.

One thought on “November 2020 Trading Review”