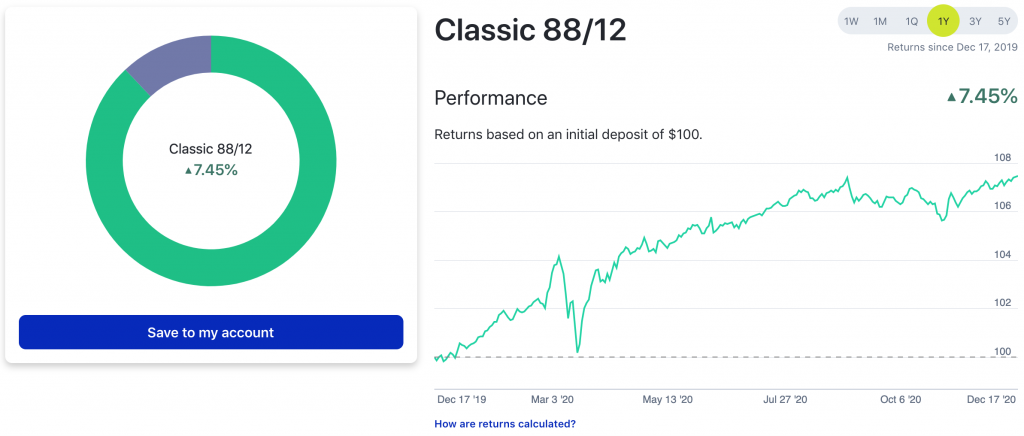

I have been looking forward to making this post since I wrote my introduction post earlier this month, stating my intention to pay down my mortgage principal early using extra monthly cashflow from recently refinancing our home to a lower interest rate. Rather than simply putting the money saved thanks to our new, reduced payment straight into the principal, I am investing the extra cash flow with options, and then using those profits to pay down the mortgage. You can read more about my general options trading strategy I will be using in this post.

I officially began this strategy on October 8. $SPY, the S&P 500 ETF, was trading at $350.10 at the time. It closed the month at $326.54, down 6.73%. Thanks to option trading, I was still able to generate premiums well in excess of my 1% monthly target. I was able to profit $152, representing a 4.9% return on my capital (that’s 78% annualized!).

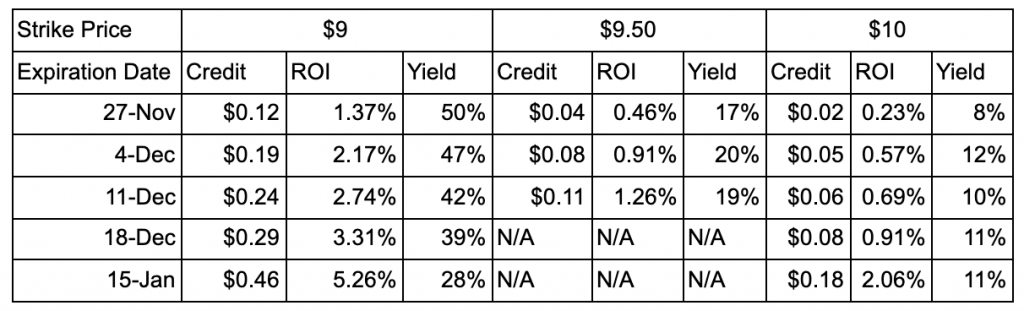

As I wrote in my previous post, the difficult part of option trading is often preserving your capital. And my holdings were far from immune from the market pull-back. After taking my premiums out to pay down the loan and setting aside a portion for taxes, my portfolio value is actually down 12.9%. I am not concerned (yet, anyway) as my positions are still at a value that I can sell premiums (with covered calls) at strike prices that would still be profitable if I had to sell at expiration and still meet my 1% portfolio goal for the month. I actually already have open positions due to expire next month that will provide at least a 2% return. I will explain the details below.

My positions & trades

O.K., confession: I actually started this journey with an existing long position, rather than $3,000 in cash like I said I would. I had 68 shares of $AAL with an average price in the low $14.XX’s. Since I was already fairly close to a 100 share position (which is required to sell covered calls), I decided to just purchase the remaining 32 shares at $13.07. I actually bought another 9 shares later in the month at $12.31 per share, bringing my average price down to $13.98. Now I can sell covered calls at $14 knowing that if my option contract is exercised, I will get all of my principal back.

$AAL, 109 shares at $13.98 ($1,523.73 total principal). Principal is currently down 19.5% ($297.48). I closed a total of four positions for a profit of $63. I currently have a $14 covered call position that I opened for a $16 credit. After the big pullbacks last week I decided to open a put credit spread at $10.50/$10, taking in a $10 credit for a $50 risk.

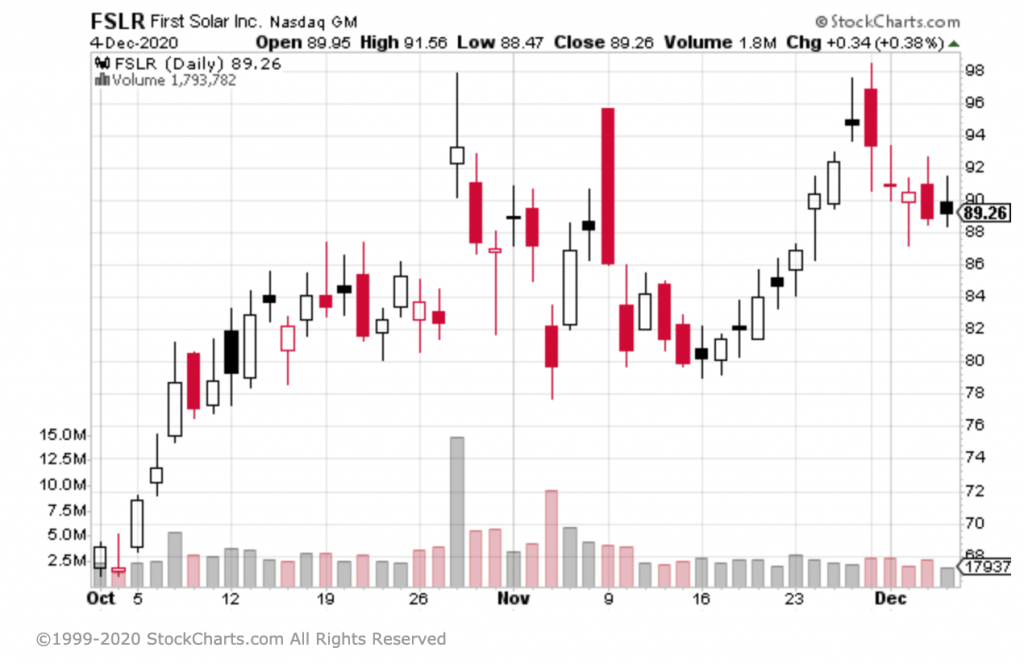

After my $AAL position, I had about $1,500 in cash left to work with. I wanted to try to split this among at least two different positions for diversity sake. Rather than selling cash-secured puts to put my capital to work, I decided to purchase 100 shares of these stocks and then immediately sell covered calls on those positions. Honestly I’m not really sure why I decided to go this route. I must have been happy with the call premiums I could get at the time.

$M, 100 shares at $6.17 ($616.76 total principal). Principal is currently up 0.4% ($2.24). I closed one position for a profit of $26. I currently have a $6.50 covered call position that I opened for a $20 credit. Macy’s is pretty volatile right now, which is why I’m able to collect some solid premiums (that $20 credit is 3% of $6.50 for an 8-day long contract!).

$GPRO, 100 shares at $6.46 ($646 total principal). Principal is currently down 8.0% ($52). I closed a total of three positions for a profit of $33. I currently have a $7 covered call position that I opened for a $17 credit. Implied volatility is great on this stock as well, giving me an opportunity to likely sell another intra-month contract at a profitable level (strike price of $6.50+).

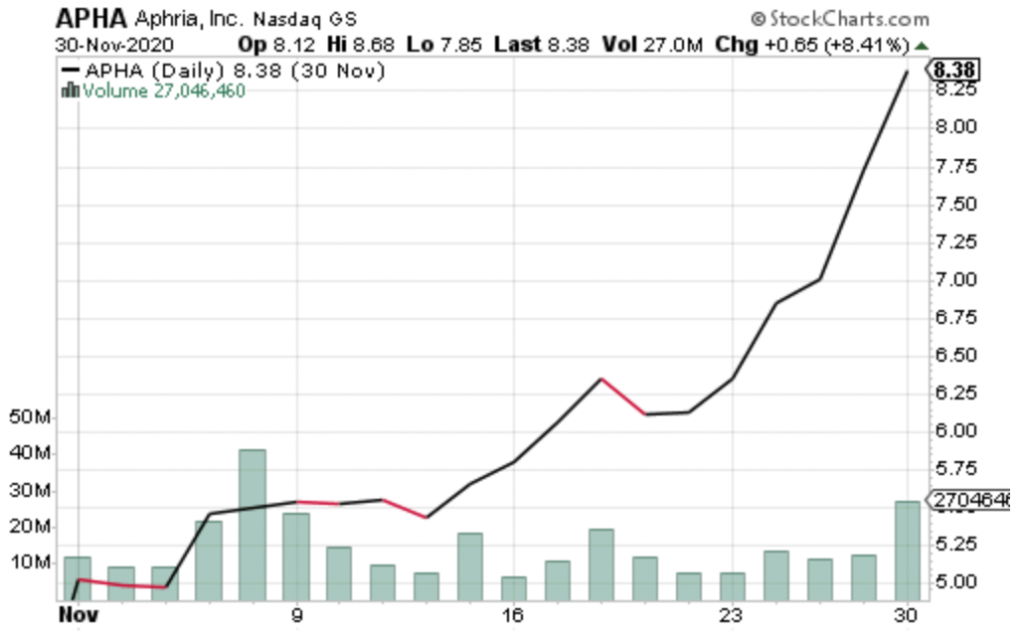

$FCEL, 100 shares at $2.34 ($233.78). Principal is currently down 14.4% ($33.78). I closed a total of two positions for a profit of $30. I currently have a $2.50 covered call position that I opened for a $15 credit. I had a couple hundred dollars left and decided to be a bit more risky. Fuel Cell is an alternative energy play from way back in the .COM days (it’s all-time high is almost $7,000 per share!). Both of the positions I closed were actually in-the-money calls ($2 strike price) that I closed because most of the value of the contract was gone once the stock price dipped. If this contract expires out of the money, I will probably look to sell another in-the-money call if I can guarantee a profit (e.g. if I sell a call at $2, it needs to be worth more than $34 to be a guaranteed profit at expiration).

Extra Mortgage Principal Paid

With $152 in net credits earned for the month, I am setting $47 aside for tax purposes. I am currently using $GNMA as my tax escrow account, so I bought $47 worth of it. $GNMA is an ETF that holds mortgage-back securities issued by the government and currently yields about 2%. It is a pretty stable ETF and I feel better about setting this cash aside for next year in something that will earn a bit of interest rather than sitting on the sidelines.

So after tax, I’m left with $105. I have decided to take $73 of that total to put directly toward my mortgage principal. That $73 puts me 254% ahead of my goal for the month and will amount to $113 savings in interest over the life of the loan. It’s a great start!

Why didn’t I use the entire $105? Since my principal had such large paper losses this month, I decided to keep a bit of that cash in my portfolio. I came up with $73 by balancing the difference between my starting principal, deposits, premiums earned, stocks purchased and the tax I’ve set aside.

Benchmark Comparisons

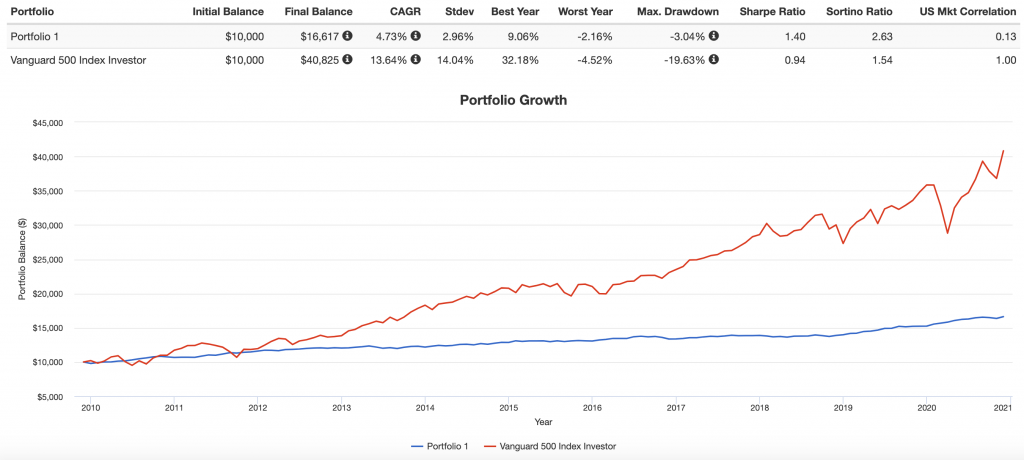

In my introduction post I identified three different benchmarks I will be comparing my performance to. Benchmark #1 is putting all of my savings from my refinance, plus a 1 month skipped mortgage payment, into a savings account. When I wrote that post I was actually getting 0.6% APY, but it has reduced to 0.5%. For comparison this month, I will stick to 0.6%. Benchmark #2 is putting all of those savings straight into extra monthly payments. This one will probably be the hardest to “beat”, but the funds are the most illiquid, which is important to me at this point in my life. Finally, Benchmark #3 is simply buying $SPY.

So how did I do this month? On paper, it doesn’t look so good. If you take my paper losses on my stock positions, add the extra principal payment I made, cash remaining in my portfolio, my $3,000 is actually down to $2,576.41. Had I put the $3,000 into my savings account, it would now be worth $3,001.50. If I had put the $3,000 into my mortgage principal, I actually wouldn’t have gained anything yet since it hasn’t compounded, so it would still only be worth $3,000. Had I bought $SPY, that $3,000 would now by just $2,798.11.

So I’m actually down 14.2% to Benchmark #1 (savings), 14.1% to Benchmark #2 (extra mortgage payments) and 7.9% to the S&P 500. Currently, putting everything into a savings account is the winner! But that will definitely change.

So here is where I rationalize my performance this month. First, a big portion of my paper losses come from those 68 shares of $AAL I had bought months ago that were already down more than 10% when I got started. That alone makes the difference in my performance deficit to the $SPY. The $73 I put towards my mortgage principal hasn’t had any time to compound yet, so that will start to grow and grow, quickly closing the gap to Benchmark #2.

Overall I am still quite optimistic and excited to see where I continue to stack up against these benchmarks. Looking forward to another month of options trading!