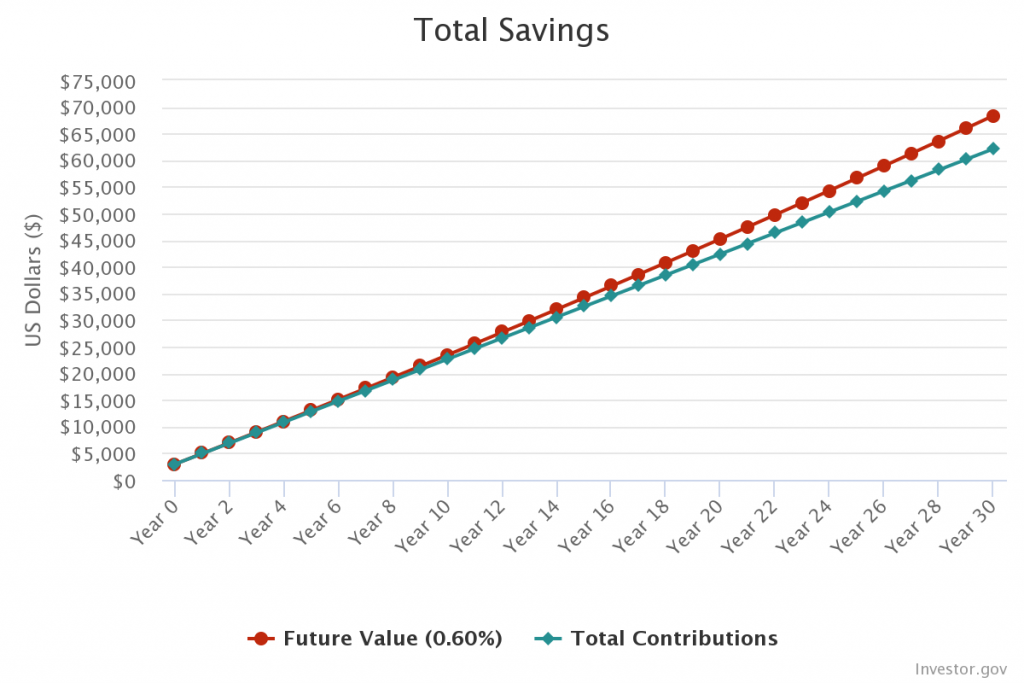

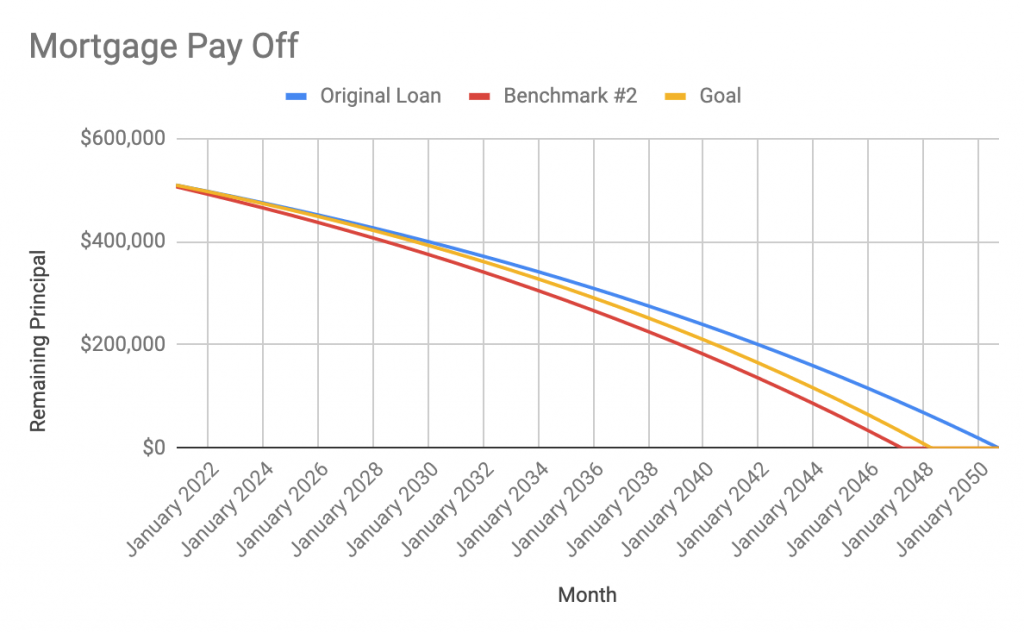

In my last post on this strategy, I introduced the plan to pay off my recently refinanced mortgage early with returns generated from options trading. The pros and cons of paying off a mortgage early aren’t discussed in that post or here, but I will likely write something about it in future posts. The capital used to fund this trading is the amount we are saving due to refinancing our loan at a lower interest rate, which is $164.21 in monthly savings. We were able to skip one month of mortgage payments (we closed in September and our first mortgage payment on the new loan isn’t due until November). Our skipped payment is the initial trading account’s starting balance (“principal”), which is $3,000. $100 of the savings will be added to the principal each month, with the remaining $64.21 going into our savings account (which yields 0.6%), at least for now.

There are further details in that introduction post, including three different benchmarks I will be comparing my results to.

In this post I want to dig a little bit deeper into the strategy I plan to use to generate my monthly return goal of 1%. The basic concept is to sell cash-secured puts and covered calls. If you are new to options trading, here are two good resources to explain what cash-secured puts (here’s a good explanation and Option Alpha has a good video) and covered calls (Investopedia and Option Alpha video) are. Basically, selling a cash-secured put gives you a premium up front for your obligation to purchase the shares at the chosen strike price. It is cash-secured because the amount you are obligated to purchase the shares at is used as collateral and is not available for trading until the contract is closed. Selling covered calls gives you a premium up front for your obligation to sell shares you currently own at the chosen strike price.

It’s actually very easy to generate 1% return on your principal each month using either of these strategies. The trick is to preserve that principal throughout market cycles. Let’s go over the risk of each strategy and how I might lose money doing this strategy. First, if I sell one $9 put contract on a stock currently trading at $10, and it drops below $9, say $8.50, then I will be down $.50 per share (or $50 total since one contract is equivalent to 100 shares). Remember I collected a premium up front for selling the put, so I’m actually down $50 less the premium received. If the premium was more than $50, I would actually still be profitable at $8.50 per share. As you can see, though, if the stock crashes, I’m losing money. If it stays above $9 at expiration then I keep the entire premium and don’t acquire the shares.

Now let’s say that I already owned the shares at $10 per share. I sell a covered call at a strike price of $11. If the stock goes above $11, I’m forced to sell it at $11 per share, even if it took off to $15. You lose the upside potential by selling covered calls. If it drops to $8.50 like the previous scenario, then I am now down $1.50 per share minus the premium received. In that situation, I still own the shares so I can sell a covered call at $11 (or $10.50 or $10 or…) the next month.

In an ideal world, I will sell puts, and the stock will always stay above my strike price. I keep the cash in my account and keep collecting premiums. If I get assigned, again ideally I just sell covered calls at above my average price on the stock. As soon as the stock comes back up to my strike price, I sell it for a profit and get to keep the premium. This is known in options trading as the wheel (Medium article).

The premium received on puts diminishes the lower the strike price is, and it diminishes on calls the higher the strike price is, relative to the stock’s current price. So if I get assigned a stock that I sold a put on, and it absolutely tanks, I won’t be able to sell calls at a profitable price because the premium will be so small. This is really the worst case scenario.

A couple strategies I have to help limit my principal losses:

- Diversify the stocks I’m working with. I’m limited by the share price of the contracts I’m selling puts on by the size of my principal since these are cash-secured puts. Starting with $3,000, the most expensive stock I can work with is $30 per share ($30 * 100 = $3,000). If that one stock crashes while I have a contract on it or own the shares, then I could be in trouble. If I instead am using three different $10 stocks, the chances of all three crashing at once is much less likely. Especially if they are in different sectors. Or even better if they have uncorrelated or opposing Betas (Investopedia Beta definition).

- Sell puts at a price where I don’t have a high likelihood of getting assigned. This is about not being too greedy or speculative. If my goal is 1% per month, I don’t need to try to get a return of 10% with a very aggressively priced put.

- Sell calls close to the money or even in the money. Opposite from puts, if I sell my calls at an aggressive price, I am more likely for the shares to be taken away from me and I lock in my profits. What I’m losing here is the upside of the stock taking off. But my goal of this strategy isn’t growth. It’s to generate regular income to pay down debt while preserving my capital.

- Use premiums to lower my average share price rather than withdrawing from the account to pay down the mortgage. If I’m down on a position, I may use the premium I used from selling a covered call to buy shares at a lower price to lower my cost basis. If it lowers my costs enough, this will actually allow me to sell calls at lower strike prices and still remain profitable. 1% in income is my goal, but not at the sacrifice of my principal. Currently, I am thinking I may do this if a stock I own is trading at a price that is more than 5% lower than my cost-basis (Investopedia Cost-Basis definition) and is one strike price lower than my cost-basis (so if I bought the stock at $10.55 and it is now trading at $10.10, I could buy more shares at $10.10, bringing my average down below $10.50 and allowing me to sell a call at $10.50 because that is now above my total cost-basis).

- In extreme cases it may be necessary to either sell the shares at a loss or start selling calls at below a profitable level. Hopefully this doesn’t happen, but it’s better then letting my principal go to $0!

Picking Stocks

The fun part! One of the keys to this strategy is to pick the right stocks. It’s best to trade companies that have a solid foundation and are likely to be around for a while. This isn’t a buy & hold strategy, however, so I don’t need to be forecasting 10 years in the future. It’s great if the stock goes up in price, and I can still make money on stocks that drop a little bit. The three killers to avoid are stocks crashing, super low options trading volume, and a large drop in implied volatility, all while holding a position in the stock.

I don’t have a strict set of criteria for stock picking for this strategy yet, but I intend to share my trades each month along with my progress. In time, I expect themes to present themselves and will hone my strategy more and more.

Progress

As long as I am continuing with this strategy, I intend to post regular updates on my progress, including trades made, profits, and the mortgage pay down progress. I am making a separate page here that will show some tables and graphs to keep track of everything in one place.

This plan is already in motion and I have made 7 trades in 4 different stocks so far. I’m excited to share my progress and begin reducing my family’s debt!