Here’s a little pause from options trading with a closer look into savings. In November I listened to Episode 67 of the Millennial Investing Podcast: “Why and How You Should Invest Your Emergency Fund with Chris Kawaja.” The episode really resonated with me. So much so that I immediately ordered Chris’s book How to Stash That Cash: The Ultimate Liquidity Portfolio on paperback from Amazon.

High Yield Savings Accounts Lose Money

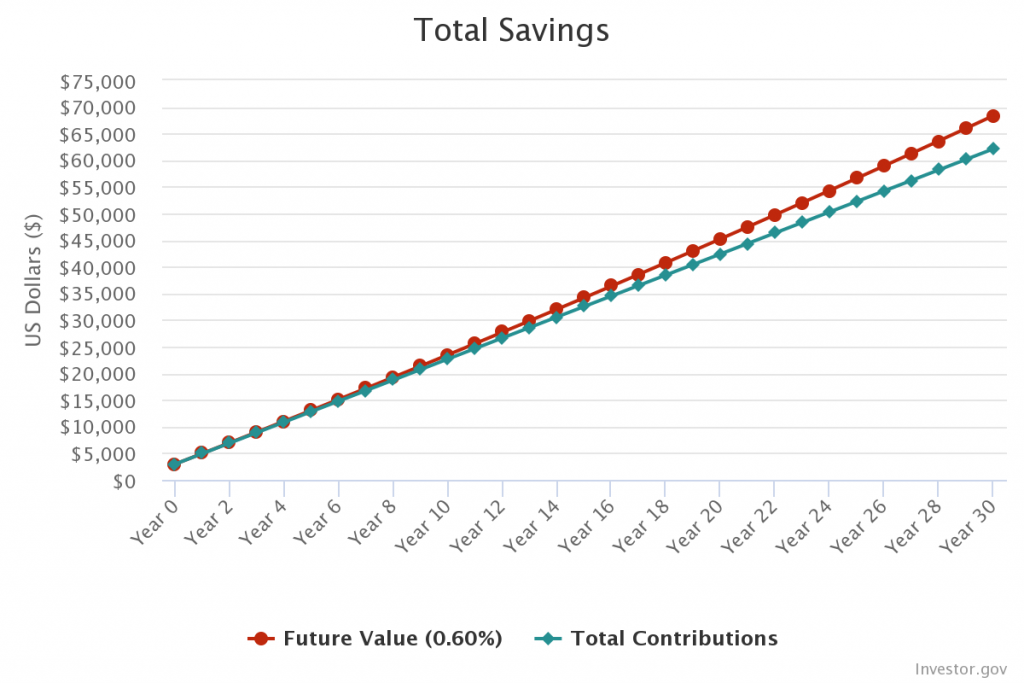

A couple days later, the book arrived and I literally read it in one afternoon. It’s short at just 98 pages. Chris gets straight to the point and clearly lays out the reasons why his “Ultimate Liquidity Portfolio” is better than stashing emergency (or opportunity) funds into “high-yield” savings accounts as I had been doing. Currently, I’m earning 0.4% APY on my high yield account. When you account for the Fed’s current target inflation rate at 2%, it is obvious that you are losing money everyday it sits in your account. The book has several charts and graphs showing just how much buying power cash has lost in the past. But there is obviously some value to knowing that the money is safely set aside and liquid for whenever it is needed.

Other Assets & Volatility

So how do you keep up with inflation? The typical answer is to buy assets. Gold, stocks, real estate… most assets will rise in value with inflation, though generally with volatility as well. The downsides to putting all of your emergency funds into any one of those assets are obvious. When you need to pull $1,000 out, for example, you want to know your asset is still worth $1,000 (not less) and it can be easily liquidated. It’s clear you aren’t going to be able to sell off a little bit of real estate every time you are in a crunch.

Also consider the reason you need access to these funds. Perhaps we are in a bear market (e.g. because of a pandemic!) and you just lost your job. If you had your “emergency” funds in the stock market, you’d be forced to sell at the same time as everyone else, losing a good chunk of your value just when you need it. This is why FDIC insured accounts like high yield savings accounts are so popular despite such low rates of return.

Diversification: The Perfect Mix

Chris has a great metaphor in his book for a perfectly diversified portfolio. Imagine you are a farmer with hens. There are two types of hens: ones that lay eggs on sunny days and those that lay eggs when it’s not sunny. If you have both types of hens, you know that you will get eggs whether it is sunny or not. This is what you want in an emergency fund, one that continues to grow in both booms and busts.

So how is this achieved in practice? With a mixture of bonds and stocks. But this isn’t your typical 60-40 stock to bond ratio. Such a portfolio is likely to grow over the longterm, but will still have more volatility than you want. Remember, you want eggs on cloudy days, too.

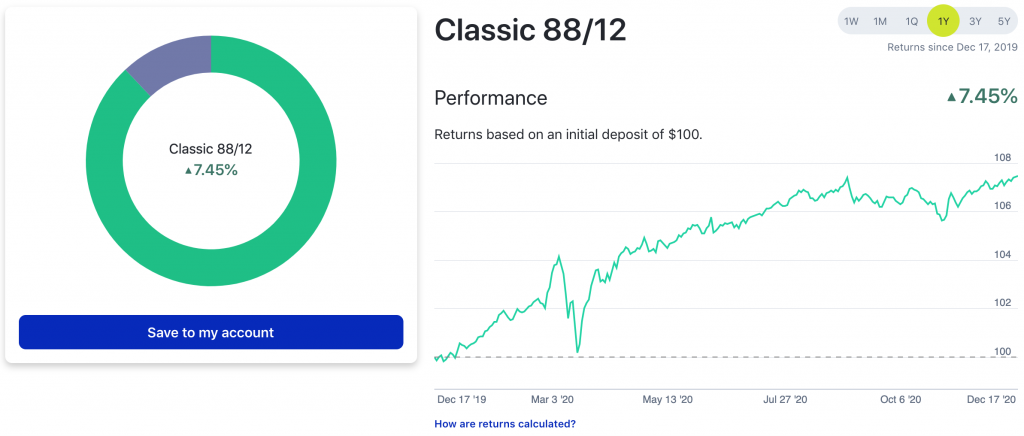

Chris’s solution is a mix of 88% intermediate term US Treasures and 12% US total stock market. Intermediate term treasuries mature in approximately 5-10 years. The two generally move in opposite directions, especially when there are big moves in the market. For example, see the chart below showing $VGIT vs. the S&P 500 this year. Just when the market was crashing in March, $VGIT started laying eggs!

Since 2009 when $VGIT was formed, it has had a -0.43 correlation to the US stock market. The 88/12% combo of $VGIT and $VTI have a combined correlation to the US stock market of just 0.11. When the stock market is zigging and zagging, the ULP is just steady.

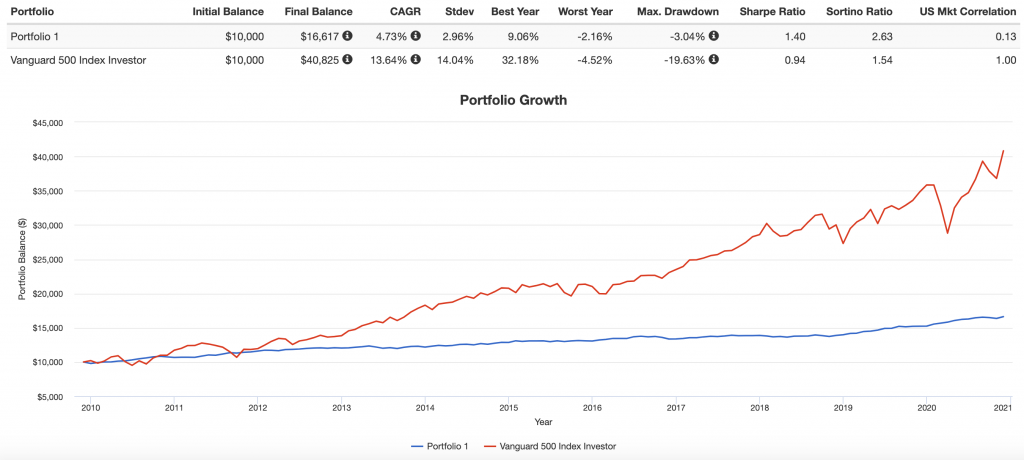

If you put $10,000 into $VTI in that time, you’d have $41,923 (13.9% CAGR), but with a max drawdown of over -20% and worst year of -5%. $10,000 in $VGIT gives you $14,381 (3.36% CAGR) with a max drawdown of -4.3% and worst year of -2.8%. The ULP slightly increases the return of the 100% bond portfolio and actually reduces drawdowns. $10,000 in the 88/12 ULP gives you $16,568 (4.7% CAGR) with a max drawdown of just -3% and worst year -2.2%. This is with an annual rebalancing. Remember that this is only looking at a short time frame in which there was a historic bull market — in other time periods, as the book shows, the ULP returns compare even more favorably with the stock market returns.

Tax Advantage

One final benefit of the ULP over savings accounts is the tax advantages. Tax implications should never be the primary driver for an investment choice, but a secondary benefit is always welcome. Interest income from the savings account will be taxed as ordinary income. Dividends from the $VTI portion are qualified, so therefore will be taxed as more favorable longterm capital gains, which is 15% for most (including myself) at the federal level. In addition, for those of us in higher taxed states, the dividends from US Treasuries aren’t taxed at all at the state and local level.

Implementing the ULP

Interested in implementing the ULP for yourself? First, I suggest you get a copy of the book first before throwing your life’s savings in it. Chris is much more qualified to give financial advice than I ever will be.

With that said, the easiest way to achieve this is with M1 Finance. M1 Finance allows you to create your portfolio with multiple “pies” where you split your portfolio among different slices. Each slice is a unique ETF or stock. In this case, the ULP pie is 88% $VGIT and 12% VTI. You can view this pie on M1 Finance here.

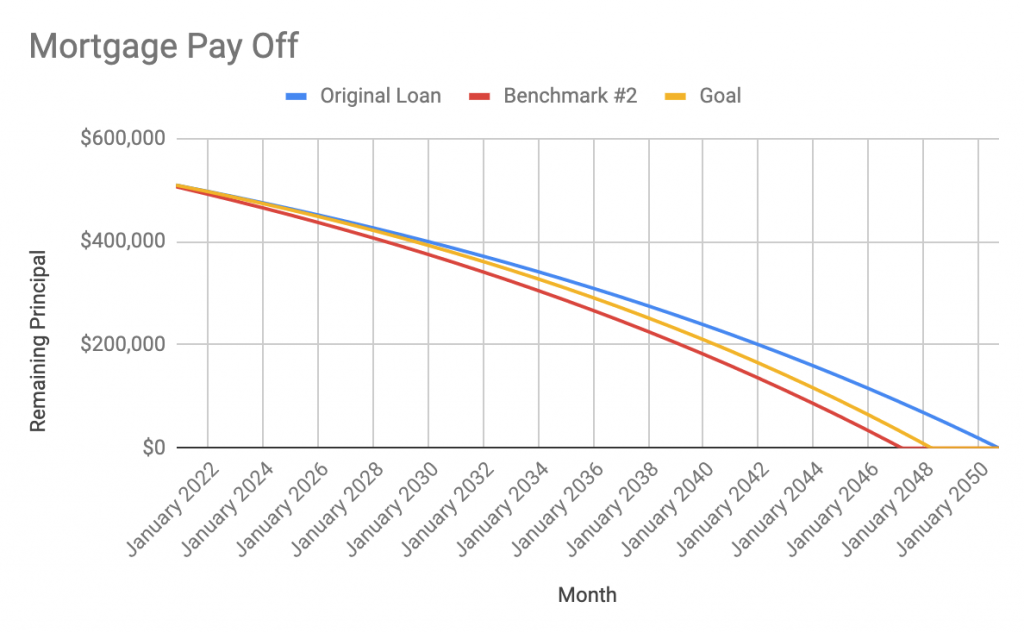

One question I’ve been wrestling with is how much to put in the ULP vs our savings accounts. Chris’s book devotes a chapter to determine how much should be in an emergency fund. He discusses unexpected costs (home repairs, healthcare expenses, auto repairs, etc.) as well as loss of income. You often hear of 6-12 months of expenses should be saved in the emergency funds. Because my wife and I both work, I actually did a calculation of how much we need to cover 6 months of our expenses living on only one of our incomes (the smaller of the two incomes). That is the goal to reach in my ULP account.

Our unexpected costs — which includes $3,000 for an expensive car repair (e.g. transmission) + 1% home value + $3,000 for a home repair (e.g. A/C repair) and the difference between our maximum out of pocket healthcare expenses and our HSA balance — are what we plan to keep in our savings account going forward. I’m not going to go over the exact numbers here (I’m realizing this is getting quite complicated and might deserve its own future post), but will say that the target values for the ULP and savings account come out to be fairly similar amounts.

Conclusion

After reading Chris’s book, I am convinced that investing some of my emergency fund into the ULP will better preserve, and potentially grow, the value of those funds compared to a high-yield savings account. I have started to implement the ULP at M1 Finance, which makes it easy to achieve the desired allocation between $VTI and $VGIT.

Chris has a blog with some interesting personal finance posts as well as some health related posts (that I haven’t really read) at upwarding.com. I commented on one of his posts and he replied via email. I was very impressed with the time and thoughtfulness he put in his correspondences with just some random reader.

Disclaimer: I am long $VTI and $VGIT. I am not a financial advisor. This is not investment advice. Please do your own research before investing in anything discussed herein. This post contains affiliate links.