This year my wife and I took advantage of the record-low interest rates to refinance our personal residence, as seemingly every other household in America has done. We purchased our home just one year ago with what we thought at the time was a solid interest rate of 3.75%. This month, we were able to refinance down to 3.125%, saving us about $200 per month. With property tax and insurance adjustments, our actual monthly Principal/Interest/Taxes/Insurance (PITI) payment reduced by exactly $164.21. Another bonus is that we were able to skip one month of payments since we closed on the new loan in September and October’s payment is not due until November 1 (mortgage is paid “in arrears”). I’ve put my mind to work lately to think about what to do with this extra savings. The number one goal is to not increase our monthly spending by that amount. We are used to making a monthly payment of $3,151.22, so I want to carry on like we are still making that same payment.

The question is what to do with the extra $164.21 to build wealth. There are two simple options that immediately come to mind.

Benchmark #1: Savings Account

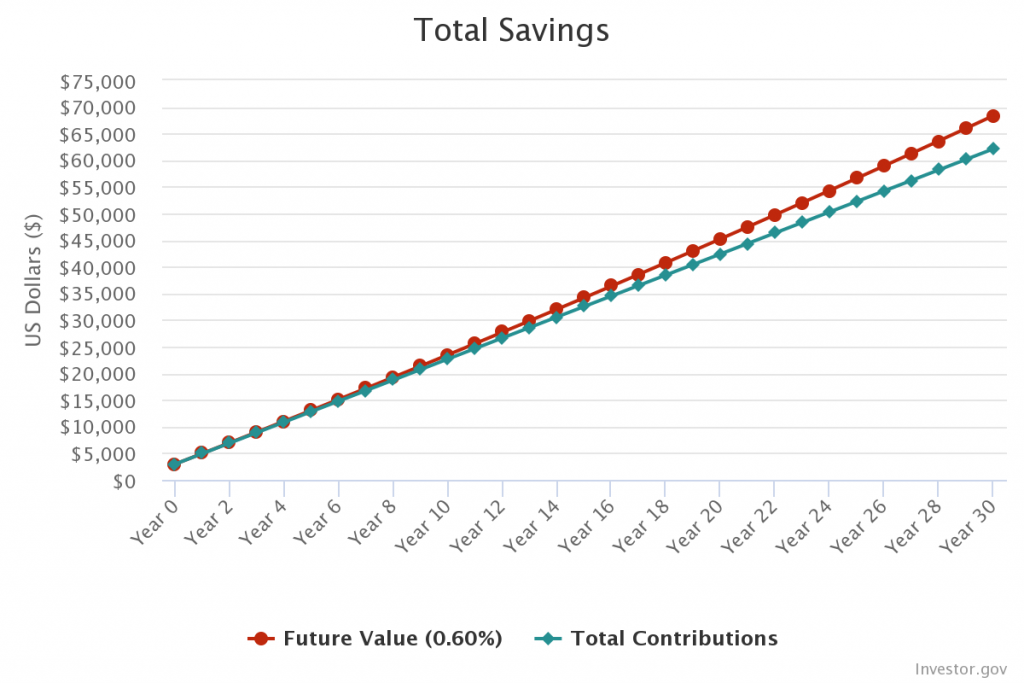

First is to put our first month of no payment (call it $3,000) plus $164.21 each month into a high yield savings account or money market. Our money market is currently earning 0.6% APY (I will use “savings account” and “money market” interchangeably throughout the rest of the post). Assuming that interest rate remains the same over the next 30 years (it won’t), that initial $3,000 plus $164.21 monthly contribution would turn into $68,343.93 (compounded monthly). Compounding interest is a hell of a drug! The biggest advantage of this idea is that it is extremely liquid and the principal is guaranteed by FDIC. When the right investment comes along (e.g. real estate rental property!), I will have this amount at my disposal!

One thing to note is that we already save some of our paychecks in this savings account, which currently sits at around ~6 months of our monthly spending after doing some fairly expensive home renovation projects in the past 12 months (new windows and floors… remind me, is your personal residence an asset or liability?). Whether or not we use this strategy, ultimately I would like to see that savings amount closer to 1 year of expenses. We also have no other debt (student loans, car payments, credit cards). If we did, the $3,000 + $164.21 would immediately go towards paying down that debt first and foremost!

Benchmark #2: Extra Principal

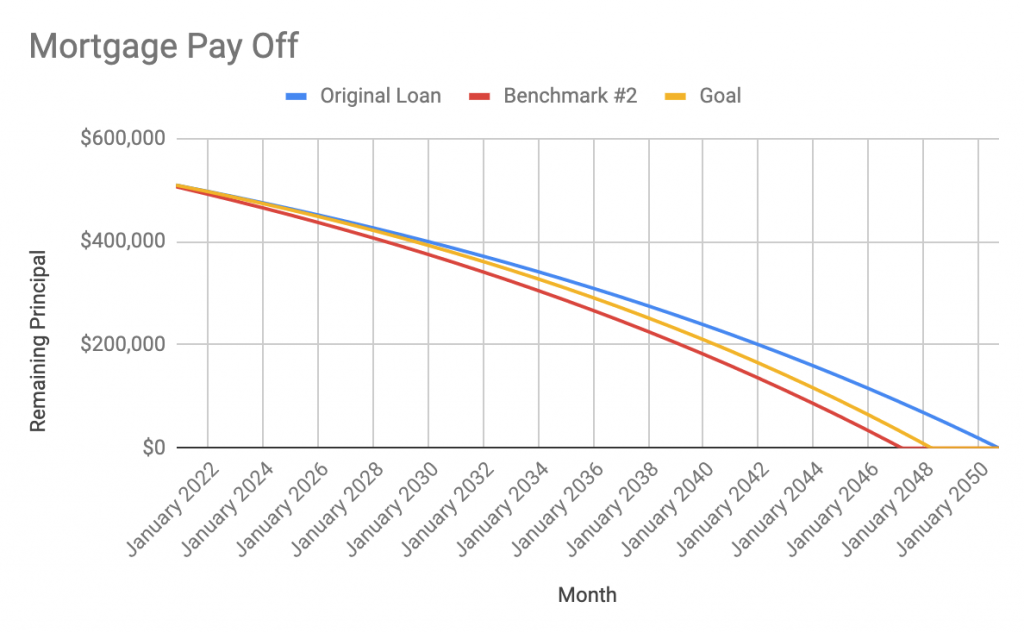

The other simple option is to make an extra principal payment on the loan of $3,000 initially, and then $164.21 each month after that. This would reduce our loan term by more than three and a half years (42 months) and save $37,490 in interest due the extra $54,890 principal payments made. If we then put the $164.21 in the savings account at 0.6% for the remaining 39 months, the sum would be $6,967.99. Adding the extra principal made, interest saved, and the final savings account sum, this strategy comes out to be worth $99,347.99, beating the all-savings option by 45%! The obvious downside here is we don’t have (easy) access to that extra $54,890 we put into equity. We could get a home equity line of credit (HELOC) to access that equity, but if my property value goes down, it’s possible I won’t be able to access any of that equity due to loan-to-value limits (we are currently sitting at about 70% LTV, for the record).

While I love the idea of reducing our $510,400 loan as it will have an immediate and guaranteed impact on our wealth (wealth = assets – liabilities), I think there is a better option, no pun intended.

If I accept a little bit more risk and work it a little bit more, I think I can get the best of both worlds (liquidity and debt paydown) with options trading. But before I go into option trading, let’s draw one more line in the sand for comparison.

Benchmark #3: Invest in S&P 500

Let’s say I put the initial $3,000 and then $164.21 into the S&P 500 and earn the often reported 8% annual yield? That number comes out to an impressive $277,539.11 after 30 years! There are obviously going to be some large market fluctuations in 30 years, but let’s use that as the ultimate benchmark. For the record, as I write this on October 9, 2020, SPY is trading at $346.21. As I go forward with tracking my progress here, I will benchmark against all three of the previous strategies, comparing returns, debt paydown, and principal.

My Strategy

What I plan to do is actually a bit of a hybrid of the three benchmarks. All the specifics of how I’m investing using options will come in future, ongoing posts, but here is the overall strategy/results I’m hoping to achieve.

On the 1st of each month, we will make a $3,151.22 payment from our checking account to the previously mentioned money market account. Prior to refinancing, this was the exact payment we were making for our PITI. From the money market account, we will transfer $100 of that to our brokerage account in which we will be investing. That account’s starting balance is at $3,000*. We will then pay $2,987.01 on the 1oth of the month to our loan servicer. Why the 10th? Because mortgage is due on the 1st of each month, but not late until the 15th. Money market accounts compound interest daily, so we are getting an extra 10 days of compounding interest. Our money market account will now have $64.21 at the end of the month.

*The account is actually already existing with a balance higher than $3,000, but I have earmarked that $3,000, plus additional payments going forward, for this specific strategy. I plan to keep very detailed records so I can really see what my returns are.

Back to the investing account, a percentage of that portfolio’s investments will then go toward paying down the mortgage, with the remaining balance being used for capital appreciation and income taxes at the end of the year. My goal for the investing account is an aggressive 1% return on the principal each month. Of that 1% return, 68.7% will go toward extra principle on the mortgage. Why 68.7%? Because our marginal federal tax rate is 22% and California state is 9.3% (31.3% total). At the end of the year, that 31.3% should more than cover extra tax liability from this income stream.

So for the first month, my investment account principal is at $3,000 and my goal is to generate $30 (1%). $20.61 goes to mortgage principal (68.7%) and $9.39 (31.3%) is set aside for taxes. On month two, my principal is now $3,100 and my goal is to generate $31, with $21.30 going to mortgage principal and $9.70 going toward taxes. And so on…

Now let’s see where my goal for this strategy compares with the other three. My mortgage will be paid down only 29 months early, with an extra principal of $44,133 made, saving $19,851 in interest. My principal in the investing account will be $39,168.40. Meanwhile, over in the savings account, the $64.21 monthly savings will have accumulated to $25,319.74. The sum total of this strategy is now $128,472. This is 88% better than all savings (Benchmark #1), 29% better than all principal payments (Benchmark #2) and 54% worse than just investing in the S&P500 ETF (Benchmark #3).

When comparing my strategy to the other benchmarks, it’s important to consider the potential returns, risks to the principal, liquidity and how passive the strategy is. Below is a table ranking each strategy, with 1 being the “best”.

| Strategy | Potential Return | Principal Risk | Liquidity | Passive |

| Benchmark #1 | 4 | 1 | 1 | 1 |

| Benchmark #2 | 3 | 2 | 4 | 1 |

| Benchmark #3 | 1 | 4 | 2 | 3 |

| Hybrid | 2 | 3 | 3 | 4 |

Clearly, my hybrid approach is a mixed bag. It is by far the least passive approach, but because of that, there is a potential for increased returns that the others don’t have, and that’s what excites me! One thing to also note is that taxes were not considered in the other three benchmarks. Interest from savings accounts are subject to ordinary income tax, mortgage interest is tax deductible, and stocks are taxed as income or longterm capital gain depending on holding period. For that reason, my hybrid strategy, in which I am accounting for taxes, is a much more realistic return.

Finally, what are the odds that I stay in this home for the next 30 years? What about keeping up with this strategy? Or writing this blog! Of course none of it will likely be going in 30 years, but I will keep this up to date and going for as long as I can/am able/am willing to!

Read my next post on my options trading investing strategy.